| Around the Horn: Extra Innings for September 27 |

| By Julie Peterson-Manz |

Published

09/27/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Extra Innings for September 27

Wednesday we had two Stocks to Watch, one Extra Inning and two Around the Horn subscription trades on our radar. All five trades hit for profits.

Canadian National Railway Co (CNI) was a Switch Hitter long for Wednesday’s Around the Horn subscription trade list. CNI hit the entry level in the morning and traded for much of the day in a consolidation. Late in the day patience paid off, with an afternoon run to the initial profit target level.

Canadian National Railway Co, 5-Minute Chart

International Game Technology (IGT) was a Switch Hitter long for Wednesday’s Around the Horn subscription trade list. First entry was in the morning, with IGT climbing just above the 50% to target level before falling back down to a scratch stop at the entry level. Second entry wasn’t long after as IGT tried once again to make a long move. This time it stuck, with some hesitation around the 50% to target level again, but eventually climbed to the profit target end of day.

International Game Technology, 5-Minute Chart

Lincoln National Corp (LNC) was a Switch Hitter long for Wednesday’s Stocks to Watch list. LNC gapped open above our price, and though we often times will take a trade that gaps beyond our price no more than 10 cents or so (remember, these used to be 1/8ths, which is really more like 12 cents), we missed this first entry and profit opportunity. If you didn’t, then exit was on the bounce down from highs on the cross of the 8 period simple moving average. Second entry was later in the day, and with some congestion at the entry price, it shot up end of day, with profit opportunities and an exit on the bounce back down form highs and, again, cross of the 8 period simple moving average.

Lincoln National Corp, 5-Minute Chart

Aspen Insurance Holdings (AHL) was a Switch Hitter long for Wednesday’s Stocks to Watch list. AHL gapped open and quickly fell back to close it’s gap. Soon thereafter, however, AHL hit the entry level and made a sharp move to the upside, including a sharp pullback. Exit was on the bounce off highs at the top of the recent daily range and cross of the 8 period simple moving average on the way down.

Aspen Insurance Holdings, 5-Minute Chart

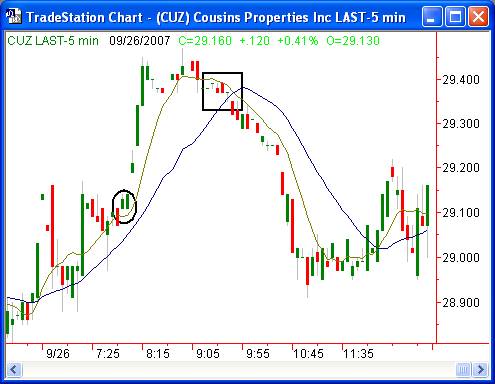

Cousins Properties Inc (CUZ) was long for Wednesday’s Extra Innings list. CUZ had an entry opportunity in the morning, with an exit an hour or so later for quick profits.

Cousins Properties Inc

Extra Innings and Opportunities for Thursday, September 27, 2007:

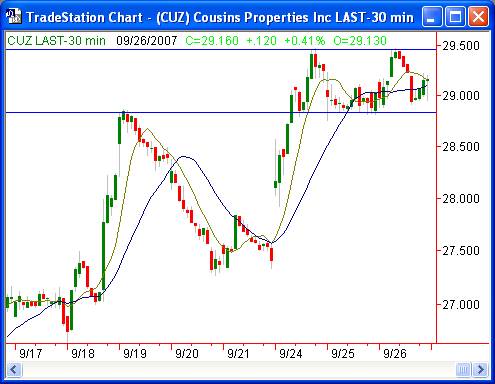

Cousins Properties Inc (CUZ) offered modest profit opportunities today and we’ll be watching again tomorrow as it tries to sort out the next direction it will take.

Cousins Properties Inc, 30-Minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, it's only $1 for a 30-day trial. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.com.

|