| Around the Horn: Extra Innings for September 28 |

| By Julie Peterson-Manz |

Published

09/28/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Extra Innings for September 28

Thursday we had two Stocks to Watch, one Extra Inning and one Around the Horn subscription trade on our radar. All four trades hit for profits.

Leucadia National Corp (LUK) was a Sinker short for Thursday’s Around the Horn subscription trade list. LUK played out a picture-perfect Sinker setup today. LUK opened and traded higher, but couldn’t maintain the momentum. The short entry hit in the morning and traded uneventfully down to the initial profit target and beyond. Exit was on the cross of the 8 period simple moving average, either when it kissed the average on a pullback or later during the afternoon consolidation.

Leucadia National Corp, 5-Minute Chart

AVON Products Inc (AVP) was a Fastball long for Thursday’s Stocks to Watch list. Entry was in the morning on rocket momentum. Exit was before noon on the bounce down from highs with a double play on the five minute chart and cross of the 8 period simple moving average.

AVON Products Inc, 5-Minute Chart

Albemarle Corp (ALB) was a Sinker for Thursday’s Stocks to Watch list. ALB gapped open but could not maintain this level. Generally the entry level on a Sinker setup, after it has exceeded yesterday’s high, is the yesterday’s high. With ALB the gap was two plus points away from this level, and under these circumstances we watch for intraday profit opportunities in the spirit of the setup. Entry level on ALB was on a breakdown of support, with an exit on the pullback and cross of the 8 period simple moving average.

Albemarle Corp, 5-Minute Chart

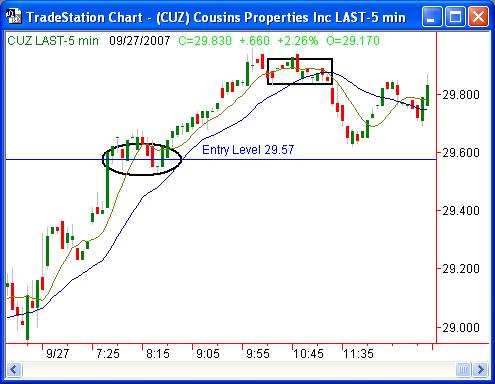

Cousins Properties Inc (CUZ) was long for Thursday’s Extra Innings list. CUZ had an entry opportunity in the morning, with an exit mid-afternoon for quick profits.

Cousins Properties Inc

Extra Innings and Opportunities for Friday, September 28, 2007:

We have had unusual trade hits in the last couple of days, with all stocks on our radar hitting (and for profits!). This leaves me with little material, as this section usually highlights stocks that were on our radar that did not hit our entry, but also did not invalidate the setup.

So, for tonight’s column, I dug a little further into earlier setups and I found one that got away from me. Frontier Oil Corp (FTO) was a Stocks to Watch Double Header short setup for September 20 that did not trigger that day or follow through for the next two days. Tuesday, however, FTO started a decline that continued through today. Tomorrow we’ll be watching to see if there is more downside to the 41.00 prior resistance level, or potentially the 40.00 prior support level.

Frontier Oil Corp, 60-Minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, it's only $1 for a 30-day trial. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.com.

|