| Around the Horn: Extra Innings for October 11 |

| By Julie Peterson-Manz |

Published

10/11/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Extra Innings for October 11

Wednesday we had five Stocks to Watch, one Extra Inning and five Around the Horn subscription trades on our radar. Of these, four hit for profits, two hit for scratch stops- one of these twice- and the rest were no-shows.

National Fuel Gas Co (NFG) was a Sinker short for Wednesday’s Around the Horn subscription trade list. Entry was shortly after the open and NFG traded down just shy of our initial profit target before bouncing back up. When our stocks come within 10 cents of the profit target, we pull the stop up to the 50% to target level. In this case, exit was at this level for all or partial shares. If partial shares remained, the trailing stop was at breakeven, and exit was just off the bounce up from the initial profit target level later in the afternoon.

National Fuel Gas Co, 5-Minute Chart

Allergan Inc (AGN) was a Sinker short for Wednesday’s Around the Horn subscription trade list. Entry was off the open and traded sharply down past the 50% to target level before bouncing back up. When our stocks hit or pass the 50% to target level, we pull the stop down to a breakeven level. In this case, exit was at breakeven level. With a second entry, the story was the same, and after two attempts, we put the stock to bed.

Allergan Inc, 5-Minute Chart

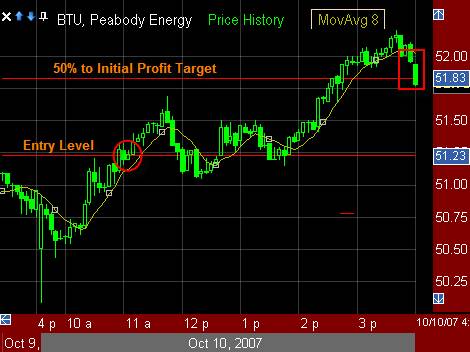

Peabody Energy (BTU) was a Fastball long for Wednesday’s Around the Horn subscription trade list. Entry was later in the morning and BTU traded in a wide range for the next couple of hours. In the afternoon, BTU started to pick up momentum, surpassing the 50% to target level before hitting end of day resistance. Exit was end of day.

Peabody Energy, 5-Minute Chart

Liz Claiborne Inc (LIZ) was a Fastball short for Wednesday’s Stocks to Watch trade list. Two entry opportunities existed, given the daily chart. Initially, a more aggressive entry was below Tuesday’s closing price, though this entry did have an intraday stop level at today’s high prior to entry. Entry below yesterday’s low was the second, typically less aggressive entry, but an intraday stop for this entry was less clear. For either entry, exit was end of day or at a trailing stop.

Liz Claiborne Inc, 5-Minute Chart

Overseas Shipholding Group (OSG) was a short for Wednesday’s Nightly Wrap and Extra Innings trade list. Two entry opportunities also existed for OSG given the daily chart. Initially, a more aggressive entry was below Tuesday’s low, as Monday’s low was only about 30 cents below. But these intraday trades are for traders, so a 30-cent target is reasonable for many traders. Entry below Monday’s low was the second, typically less aggressive entry, but most likely resulted in a scratch stop the first entry. Second entry for either was profitable and exit for both was early afternoon on a bounce up off of lows after a sharp decline and cross of the 8-period simple moving average on S&P strength.

Overseas Shipholding Group, 5-Minute Chart

Extra Innings and Opportunities for Thursday, October 11, 2007:

Weingarten Realty Inc, 30-minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, try it free for a week. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.com.

|