| Around The Horn: Extra Innings For May 8 |

| By Julie Peterson-Manz |

Published

05/8/2008

|

Stocks

|

Unrated

|

|

|

|

Around The Horn: Extra Innings For May 8

Wednesday, May 7, we had five Stocks to Watch and three Around the Horn subscription trades on our radar. Of these, one was profitable, one was a scratch, one gapped past the entry and five were no-shows.

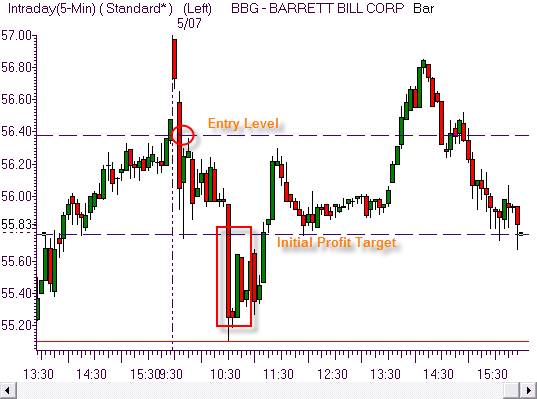

Barrett Bill Corp (BBG) was a Sinker short for Wednesday’s Around the Horn subscription trade list. BBG opened above yesterday’s high, qualifying our setup. Our entry was triggered moments later and the initial profit target hit within the next hour. Exit was at this level or below.

Barrett Bill Corp (BBG), 5-Minute Chart

Canadian National Res Ltd (CNQ) was a Sinker short for Wednesday’s Around the Horn subscription trade list. CNQ opened above yesterday’s high, qualifying our setup. Our entry was triggered moments later and the initial profit target hit within another several minutes. Exit was at this level. Second entry was after a pullback above the opening price, and again the profit target was hit moments later.

Canadian National Res Ltd (CNQ), 5-Minute Chart

Trinity Inds Inc (TRN) was a Switch Hitter long for Wednesday’s Around the Horn subscription trade list. TRN opened and quickly hit our entry price. TRN quickly traded to the initial profit target, with an exit at this level or as close as possible.

Trinity Inds Inc (TRN), 5-Minute Chart

Fresh Del Monte Produce Inc (FDP) was an Extra Inning short. FDP opened and traded higher, above the central pivot and toward yesterday’s highs before falling again in an exhaustion move. Entry opportunities presented themselves on the pullback from these highs or on the cross of the central pivot. Exit was the last part of the day, anywhere on or below the S1 pivot.

Fresh Del Monte Produce Inc (FDP), 5-Minute Chart

Extra Innings and Opportunities for Thursday, May 8, 2008:

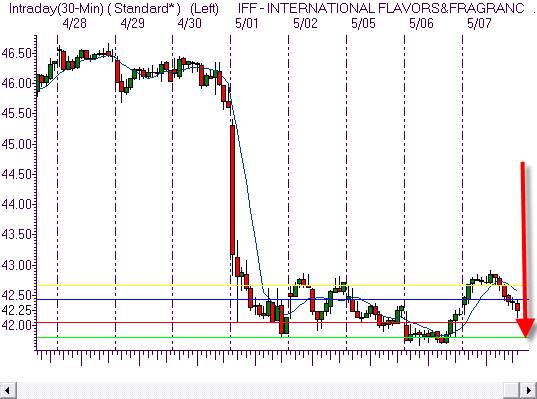

International Flavors & Fragrance (IFF), 30-Minute Chart

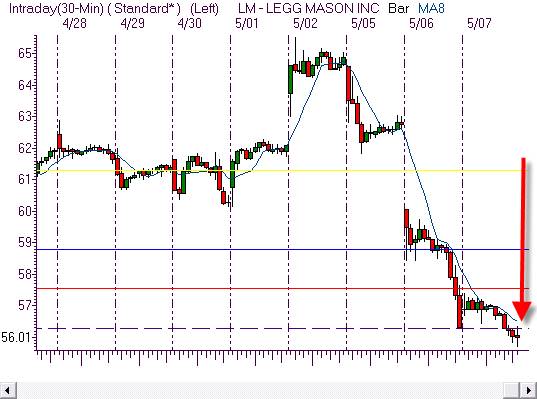

Legg Mason Inc (LM), 30-Minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, try it free for a week. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.

|