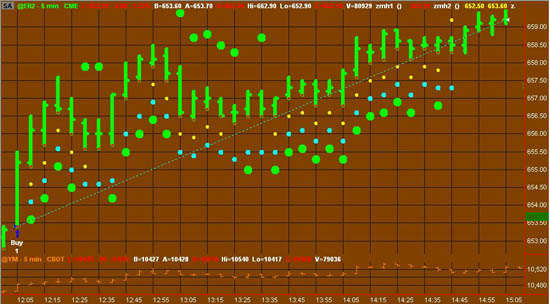

We never stop working in the Art Collins Laboratories. Our personal Moby Dick quest of late has been to find day trading systems in the indexes. As we have mentioned in prior columns, one of the things that produces a bias is trying to be long only if you're above the daily open and vice versa for shorts. As we've demonstrated before, we enjoy taking a basic idea like that and combining it with others. What follows is a visual depiction of acting when four out of four indicators all point the same way (Figure 1), and then the performance results in the three indexes we follow (Figures 2 through 4).

Four components are displayed as “show me” indicators in Figure 1â€"(the colored dots). Email me at artcollins@ameritech.net and I'll send you the “show me” code. After receiving the code, you may find it rewarding just to scroll through the 5-minute bars as I've displayed in Figure 1. Even if you don't follow the exact system I've outlined, there are clearly other trade opportunities within the overall concept.

Here to view a larger version of the above chart. (The larger chart will open in a new browser window.)

Here are the individual signals for longsâ€"shorts are the opposite. The open and close refer to Regular Trading Hours for the E-minis.

- The last 5-minute close is above the daily opening price.

- The net change of the primary market you're looking at is stronger on a percentage basis than the Dow futures.

- The majority of the previous 7 bars have closes higher than the opens.

- The close is greater than the previous 5-bar closing average.

In addition, one more qualifier must be occurring when the four signals line up. The previous open to close must also be pointing in your attempted direction. In other words, if you get a +4 buy signal, the previous open to close had to be positive.

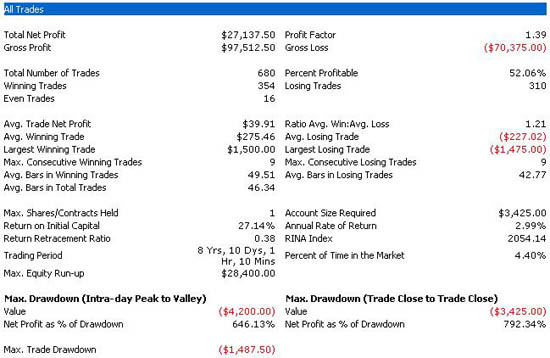

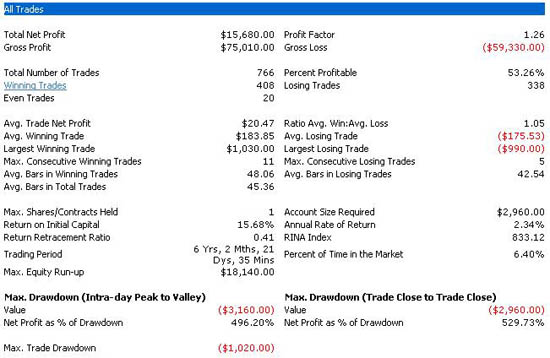

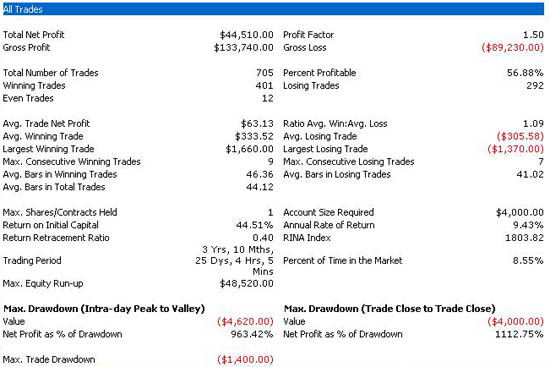

The following are the performance results for the S&P 500, Nasdaq 100, and Russell 2000 E-mini futures contracts.

S&P 500

Nasdaq 100

Russell 2000

You initiate trades from 9:00 a.m. until 2:45 p.m. Central Time. You're always out at 3:00 p.m. This doesn't have stops, profit targets, etc., but I have found some effective variations along those lines. I am still tinkering as usual.

Art Collins is the author of Market Beaters, a collection of interviews with renowned mechanical traders. He is currently working on a second volume. E-mail Art at artcollins@ameritech.net.