| Why Does The Drop In Oil Prices Matter? |

| By Kathy Lien |

Published

12/20/2008

|

Currency , Futures , Options , Stocks

|

Unrated

|

|

|

|

Why Does The Drop In Oil Prices Matter?

Oil prices are trading at $33 a barrel and in retrospect, it is almost hard to believe that the price of crude was more than $140 a barrel this summer (gasoline prices were greater than $4.00 a gallon).

Since those highs, oil prices have plunged more than 70 percent and gas prices are down more than 50 percent. If we discount the run up in the first half of the year, we have still seen a 55 percent drop in oil prices since January.

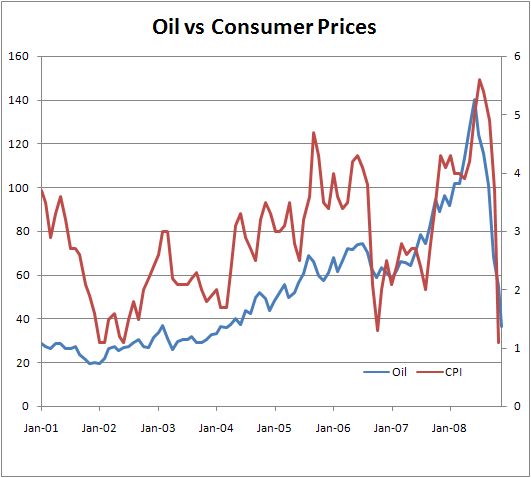

Crude prices matter for a variety of reasons. Lower oil prices help to cushion the ever dwindling pocketbooks of US consumers. In addition, oil has a direct correlation with consumer prices. With CPI falling for 2 consecutive months, the risk of deflation is growing.

Take a look at the strong correlation between the price of oil and consumer prices.

Kathy Lien is Director of Currency Research at GFT, and runs KathyLien.com.

|