From a technical perspective, the US Oil Fund ETF (USO) is screaming for a recovery rally.

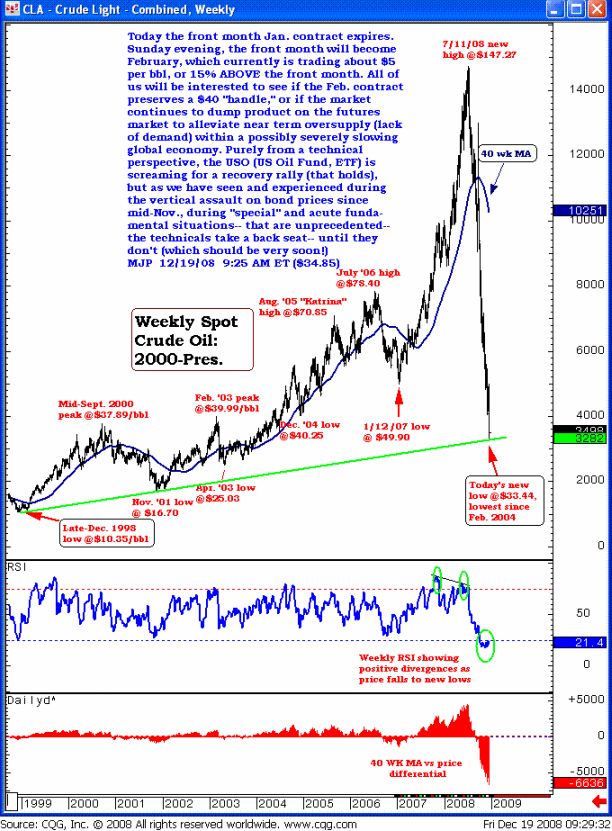

Looking at oil, the front month January contract expires. On Sunday evening, the front month will become February, which currently is trading about $5 per barrel, or 15% above the front month. All of us will be interested to see if the February contract preserves a $40 "handle," or if the market continues to dump product on the futures market to alleviate near-term oversupply (lack of demand) within a possibly severely slowing global economy.

Purely from a technical perspective, the US Oil Fund ETF (USO) is screaming for a recovery rally (that holds), but as we have seen and experienced during the vertical assault on bond prices since mid-November, during "special" and acute fundamental situations that are unprecedented, the technicals take a back seat until they don't, which should be very soon.

Mike Paulenoff is a 26-year veteran of the financial markets and author of MPTrader.com, a real-time diary of his technical chart analysis and trading alerts on all major markets. For more of Mike Paulenoff, sign up for a free 15-Day trial to his MPTrader Diary by clicking here.