| Around The Horn: Extra Innings For January 6 |

| By Julie Peterson-Manz |

Published

01/6/2009

|

Stocks

|

Unrated

|

|

|

|

Around The Horn: Extra Innings For January 6

Monday, January 05, 2009, we had four Around the Horn premium trades and four Stocks to Watch trades on our trade list. Of these, three had profit opportunities and the rest were no-shows.

Arch Coal Inc (ACI) was a Fast Ball long Around the Horn trade for Monday. ACI opened below Friday’s closing level but immediately traded higher, triggering our entry. After fighting against the broader market, which opened gapped down and kept trading lower, ACI finally ticked lower, shaking us out at the stop loss price. It barely touched this level, however, and when ACI traded back up to the entry, we were loaded and ready to go. This second entry worked out, trading first to the 50% to target level where we moved the stop to breakeven. Then to within 10 cents of the target, where we moved the stop to the 50% to target level. ACI hit our initial profit target and kept trading higher. Exit could have been at this level, but we were in for the rise and trailed the stop with support and resistance on a 25 tick chart, exiting at the break of the 19.85 support.

Arch Coal Inc (ACI), 5-Minute Chart

Amdocs LTD (DOX) was a Fast Ball long Stocks to Watch trade for Monday. DOX opened and traded higher, despite broader market resistance. An entry at or below the suggested entry had an initial stop just below Friday’s closing range. As DOX traded higher, this stop was moved higher as well. Profits made sense if taken at the R1 pivot level or later at the R2 pivot level, depending on the trader’s latitude in trailing stop.

Amdocs LTD (DOX), 5-Minute Chart

Boston Properties Inc (BXP) was a Switch Hitter short Stocks to Watch trade for Monday. BXP opened and traded lower. Several opportunities existed for making money in BXP today, including multiple entries at last night’s suggested entry price. These entries were good for more than .40 each, with the last entry below a consolidation at resistance offering the opportunity for even more.

Boston Properties Inc (BXP), 5-Minute Chart

Extra Innings and Opportunities for Tuesday, January 6, 2009:

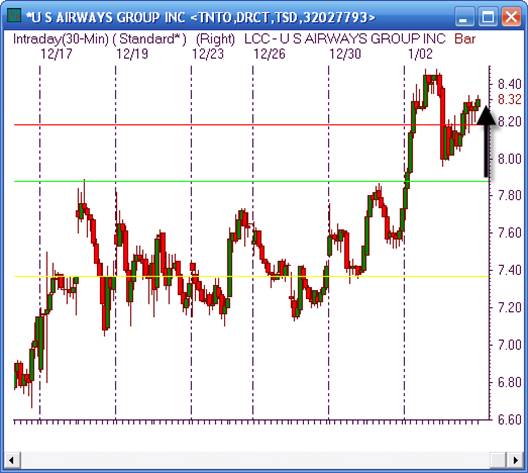

US Airways Group Inc (LCC), 30-Minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, try it for one week for $5. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.

|