| EUR/USD: Seasonality Factors In Play? |

| By Kathy Lien |

Published

01/12/2009

|

Stocks

|

Unrated

|

|

|

|

EUR/USD: Seasonality Factors In Play?

We are continuing to see the reverberations of Friday’s non-farm payrolls report on the currency market this morning. The dollar is extending its losses against the Japanese Yen and rebounding against the Euro and the British pound.

Japanese markets were closed for Coming-of-age Day and there was no major economic data released from any of the G10 countries. However traders should not be complacent because this will be a big week in the currency market.

There are 2 factors adding pressure on the Euro today - the strong possibility of an interest rate cut by the ECB on Thursday and the creditwatch downgrade of Spain by Standard and Poor’s. Spain is on CreditWatch negative which means that they are at risk of losing their AAA rating. There is no question that the Eurozone economy is weakening and it will be just a matter of time before ECB monetary policy appropriately addresses.

As for the US dollar, the sell off could continue against the Japanese Yen if consumer spending slows materially. Now that the holiday shopping season is over, retailers are reviewing their books and are faced with the difficult decisin of whether or not to file bankruptcy protection. According to this morning’s WSJ, Loehmann’s, Duane Reade, Bon-Ton Stores and Claire’s Stores are all at risk. However, there is a chance that we could see a smaller decline since the pace of contraction is slowing according to the ICSC and SpendingPulse report.

The most consistent trend that we are seeing in the financial markets is the sell-off in oil. Crude prices are below $40 a barrel, sending the Canadian dollar lower against the US dollar and Japanese Yen.

The EUR/USD has fallen close to 4 percent or 600 pips since the beginning of the year. Although fundamental factors are certainly in play, there are seasonal factors as well.

Back in December, I published article warning about the seasonal effect on the EUR/USD.

Looks like it is playing out as expected:

One of the new chapters in my book, Day Trading and Swing Trading the Currency Market, is on seasonality.

Technical analysis is based on the idea that price patterns repeat themselves and seasonality is rooted from this very same concept.

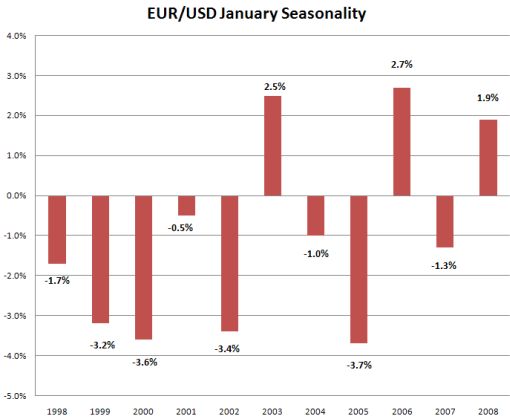

According to the following chart, over the past 10 years the EUR/USD depreciated in the month of January 7 times. If we expand the chart to include 1997, which I cover in the book, that would be 8 out of 11 times.

Of course, like all technical analysis, the pattern does not always repeat itself which is why we saw the EUR/USD rise in the month of January during 2003, 2006 and 2008.

Kathy Lien is Director of Currency Research at GFT, and runs KathyLien.com.

|