| Around The Horn: Extra Innings For January 13 |

| By Julie Peterson-Manz |

Published

01/13/2009

|

Stocks

|

Unrated

|

|

|

|

Around The Horn: Extra Innings For January 13

Monday, January 12, 2009, we had three Around the Horn premium trades and three Stocks to Watch trades on our radar. Of these, one had profit opportunities, one was a loss and the rest were no-shows.

Wolverine World Wide Inc (WWW) was a Fast Ball short Around the Horn premium trade for Monday. WWW opened and traded lower through our entry level. WWW looked good going in and came within 5 cents of our 50% to Profit Target level, but not quite. WWW then traded higher and took us out at the stop loss level. I mean barely hit the stop loss and took us out- we hate that, but followed the plan. A second entry came later in the session but closed out breakeven.

Wolverine World Wide Inc (WWW), 5-Minute Chart

Abbott Labs (ABT) was a Switch Hitter short Stocks to Watch trade for Monday. ABT had a couple of decent entry opportunities a little later in the session. An entry above this level on contracting range with a stop at the lows was a logical entry level for profit opportunities. A second entry opportunity at the same level presented itself closer to mid-session.

Abbott Labs (ABT), 5-Minute Chart

On Friday, January 9, 2009, we had four Around the Horn premium trades, three Extra Innings and five Stocks to Watch trades on our radar. Of these, two had profit opportunities, two were losses and the rest were no-shows.

Emerson Electric Co (EMR) was a Switch Hitter long Around the Horn premium trade for Friday. EMR opened and traded higher triggering our entry, only to turn around and trade right down to our stop.

Emerson Electric Co (EMR), 5-Minute Chart

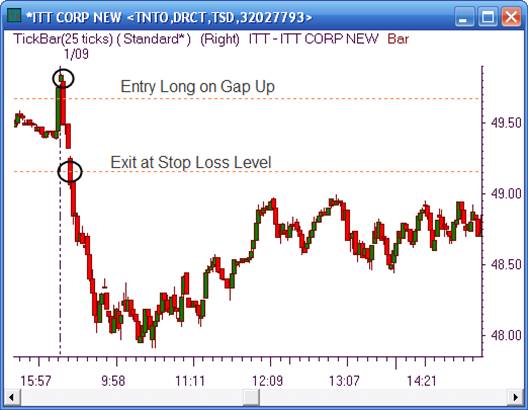

ITT Corp (ITT) was a Switch Hitter long Around the Horn premium trade for Friday. ITT opened and traded higher triggering our entry, only to turn around and trade right down to our stop. I show this on a 25 Tick chart because it looks impossible on a 5 minute chart that we entered the trade, but it looked terrific on the open and gapped higher.

ITT Corp (ITT), 25-Tick Chart

Red Hat Inc (RHT) was a Switch Hitter long Around the Horn premium trade for Friday. RHT opened and traded lower, finding some support in the morning session. Mid-session RHT triggered our entry and continued up and to our initial profit target. Exit was at this level near end of day.

Red Hat Inc (RHT), 5-Minute Chart

Shaw Group Inc (SGR) was a Fast Ball long Stocks to Watch trade for Friday. SGR opened and traded lower, but found some support just under the R1 pivot level. An entry above this level on contracting range with a stop at the lows was a logical entry level for profit opportunities. A second entry opportunity at the same level presented itself closer to mid-session.

Shaw Group Inc (SGR), 5-Minute Chart

Extra Innings and Opportunities for Tuesday, January 13, 2009:

ITT Educational Services Inc (ITT), 30-Minute Chart

Wolverine World Wide Inc (WWW), 30-Minute Chart

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, try it for one week for $5. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.

|