| FOMC Preview: Will the Rate Decision Impact the Dollar? |

| By Kathy Lien |

Published

01/27/2009

|

Currency

|

Unrated

|

|

|

|

FOMC Preview: Will the Rate Decision Impact the Dollar?

For the first time since August 2007, the Federal Reserve is not expected to change interest rates. With the fed funds rate now set to a target range of 0 to 0.25 percent, the Federal Reserve has maxed out on their most conventional monetary policy tool. Although they still have different ways of adding liquidity to the financial system and stimulating the economy, what was once the second most market moving event risk for the foreign exchange market could become a non-event. Going forward, traders may have the same disregard for FOMC rate decisions as they do for Bank of Japan meetings. The only way for Wednesday’s FOMC rate decision to hurt the dollar would be if the central bank announces that they will be purchasing long term US Treasuries in size or if they add more ingredients to their alphabet soup of new programs. There is nothing to support the dollar on the upside as the Fed is not expected to start talking about raising interest rates.

FOMC Decisions Could Become a Non-Event for the US Dollar

The last time that the Federal Reserve drew an end to a major easing cycle was in 2003 when they took interest rates to 1 percent from a high of 6.5 percent in 2000. At that time, interest rates hit the lowest level in more than 40 years. The last rate cut that the Federal Reserve made during that easing cycle was in June 2003. The following charts illustrate how the EUR/USD traded following the next 2 interest rate decisions at which interest rates were left unchanged at 1 percent. In August of 2003, the EUR/USD fell 30 pips in the hour following the rate decision and by the open of the European trading session it was down a total of 80 pips. The move was very gradual and happened over the course of many hours, which is unlike the type of volatility seen after recent FOMC rate decisions. The same indifference to the FOMC rate decision happened in September 2003 as well. The EUR/USD fell less than 20 pips in the hour following the rate decision and proceeded to fall another 30 pips over the next 8 hours. These analogies as well as the market’s lack of reaction to Bank of Japan rate decisions suggest that we may not see much of a reaction to Wednesdays’ FOMC announcement. The sell-off in the US dollar against the Euro, British pound and commodity currencies going into the rate decision indicates that traders expect the Federal Reserve to announce some new measures that would indicate that they are moving deeper into credit easing. If that is the case, we could see more dollar weakness but if the Fed under delivers and does nothing but express concern about the outlook for the US economy it could help more than it hurts the US dollar because credit easing is dollar negative.

US Economic Performance Since Last Rate Decision

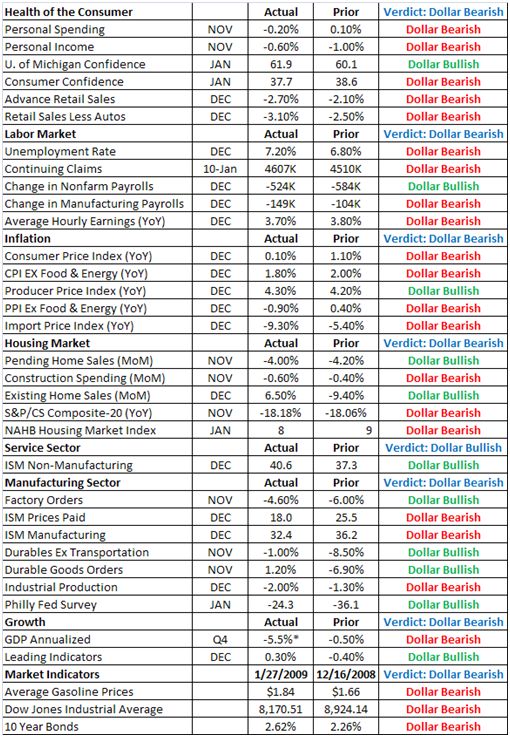

Ask the average American and they will tell you that the US economy has worsened since the last interest rate decision and the numbers also show that. Unemployment has soared to 7.2 percent, consumer confidence has hit a record low, while inflation and equity prices continued to fall. The massive layoff announcements on Monday are just be the tip of the iceberg. More layoff announcements are expected and unfortunately that can create a vicious cycle of weaker consumer spending and corporate earnings. The US economy is in urgent need of some additional stimulus but the more that the US government spends the greater the risk of a turn in the US dollar. Here is a snapshot of how economic data has fared since the December rate decision.

What to Expect from Credit Easing

Two weeks ago, Federal Reserve Chairman Ben Bernanke outlined what he plans to do now that interest rates are basically at zero. In a speech at the London School of Economics, Bernanke talked about the additional tools available to the Fed, an orderly exit strategy, concerns about inflation and suggestions about how the Obama Administration should use the remainder of the TARP funds. Most importantly, Bernanke created a new name for his regime – credit easing. In contrast to Quantitative Easing, which Bernanke explains focuses on the liabilities portion of the central bank’s balance sheet, Credit Easing focuses on expanding the asset side of the balance sheet. However since the balance sheet is suppose to balance, this may be nothing more than a difference of semantics since both efforts ultimately add liquidity into the financial system. The Federal Reserve wants to draw a distinction between their current policies and the Bank of Japan’s policies between 2001 and 2006.

The Fed’s Toolbox

As for the tools that they have at their disposal, there is nothing groundbreaking. Their number one tool is policy communication, followed by liquidity facilities for banks, facilities for other markets and purchases of long term securities. Interest rates will remain low for an extended period of time. In terms of an exit strategy, Bernanke expects demand for the emergency facilities to wane as the US economy improves. Like many members of the Bush Administration, Bernanke supports using the rest of the TARP funds on the credit markets. Without stabilization in the financial system, he does not believe that any fiscal stimulus will have a lasting impact on the economy.

Kathy Lien is Director of Currency Research at GFT, and runs KathyLien.com.

|