| A Turn In USD/JPY? |

| By Kathy Lien |

Published

01/30/2009

|

Currency

|

Unrated

|

|

|

|

A Turn In USD/JPY?

There are many reasons to believe that USD/JPY will head lower in the coming months, most of which centers around the weak US and global economic outlook.

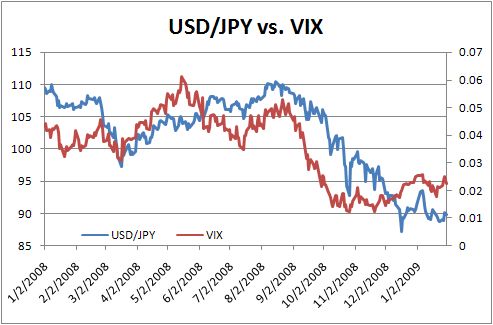

However there is one reason why we could see a turn and that is the correlation between USD/JPY and the VIX (which measures the volatility in the equity market). Usually when the VIX (which is inverted in the following chart) rises, USD/JPY falls because high volatility tends to propel investors into the safety of the Japanese Yen.

EUR/CHF on a Tear - The Swiss Are Going Crazy

The Swiss are going crazy because they can’t figure out what to do with their currency. Yesterday, EUR/CHF collapsed after SNB President Roth ruled out intervention. This morning, the currency pair completely reversed its earlier losses because the Finance Minister said that the government would support the SNB in selling Swiss Francs. Thankfully it only happened AFTER EUR/CHF hit my target of 1.4825.

It certainly smells like there are some political disputes over in Switzerland, which is never good for a currency. Either way, USD/CHF is in the buy zone and there is a lot of support around the 1.1375 to 1.1420 level. We could see a move up to 1.18.

Kathy Lien is Director of Currency Research at GFT, and runs KathyLien.com.

|