When most traders talk about options pricing models, the main unknown factor is the anticipated volatility of the stock over the estimated holding period of the option. The historical volatility of a stock over a recent period of time is considered to be the first benchmark to estimate future volatility. For a stock that is not making wide swings, an option will typically be priced cheaper than for a stock making more volatile swings up and down. But this can change should a quiet stock be expected to make a big move following an upcoming event like earnings or other important news item for a stock or its sector. The key is the expectation of volatility to come. This is called implied volatility, in which the current option price can grow rich or cheap relative to historical volatility, based on the market's perceptions of what movement is to come. Read on for more on the difference between a stock's volatility and its trend.

Most options analysts will tell you to focus on the volatility assumption within the options pricing model, as that is the only factor the standard options model assumes to be unknown. Stock price is assumed to be basically unchanged, except for a carrying cost equivalent to the short-term interest rate. This assumption is due to the Efficient Market Theory notion that stock prices incorporate all available information and cannot be predicted into the future. We believe trends occur and can be predicted, and thus this options pricing model assumption creates an opportunity for option traders. Our approach is to focus first on the expected movement in the underlying stock's price, as we find the average off-the-floor option trader gets a much bigger impact from a given percentage gain in the stock than from the same percentage change in the volatility assumption. Let?s look at the example of XYZ December 60 call options with approximately 10 weeks until expiration:

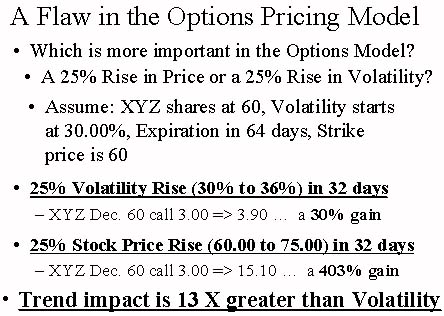

Impact of 25% Rise in Volatility vs. 25% Rise in Stock Price

As you can see, the 25% gain in the stock price amounts to a 402% gain in the option price, while the 25% jump in volatility leads to a 30% gain in the option price. If these events are equally probable, you have about a 13-to-1 edge in focusing on the stock price change relative to the volatility change. Looked at another way, the 25% change in volatility would have to occur 13 times for every one time the stock price changed by 25%, if there were to be no edge in focusing on expected stock price over volatility. Individual option traders will find much more value in focusing on expected stock price. Clearly the bigger the expected trend, the bigger your edge versus the standard option pricing assumptions.

Note that there are adjustments you can make for your comfort level as well. Many times traders will be too optimistic in the scenarios they input, and a way to moderate this is by employing one of the following two tactics. Traders wanting to employ more conservative tactics can either buy one strike further in-the-money, or buy the next expiration month further than you think you'll need. Option traders, or any traders or investors, will always be faced with being wrong no matter what they do: if the position is a winner, you should have bought twice as much, or if the position loses, you should have never bought it. The point is that we can always second-guess ourselves, but we will better positioned over many trades taking a more conservative approach to mitigate those situations which could knock us out of the game entirely, as opposed to worrying that we left some profits on the table by choosing a less leveraged option.

Price Headley is the founder and chief analyst of BigTrends.com, which provides daily stock and options recommendations and education.