| Corcoran Technical Trading Patterns For October 30 |

| By Clive Corcoran |

Published

10/29/2009

|

Stocks

|

Unrated

|

|

|

|

Corcoran Technical Trading Patterns For October 30

The market bounced back from an oversold condition following Wednesday’s decisive moves to the downside. The better-than-expected GDP numbers helped sentiment, but one was left with the suspicion that a lot of the buying yesterday was from those who were still short from the more technically adroit decision making that prompted the recent weakness.

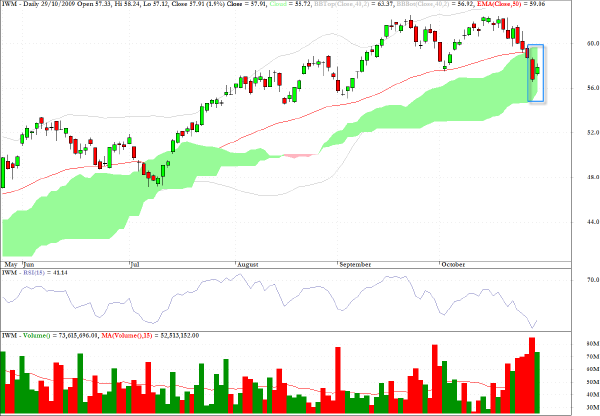

IWM, the proxy for the Russell, did not exhibit a robust recovery as would be expected if the primary motivation behind the rebound was a true celebration of improving fundamentals which would play to the benefit of the smaller-cap stocks. Traders, in my opinion, need to embrace the higher beta stocks again if there is going to be another strongly bullish impulse. Overall, I am leaning to the view that we are still not through with this corrective episode and I would still be targeting 550 on the Russell 2000 or about 55 on the IWM.

Similar comments to those above for IWM can also be applied to the sector fund which tracks the DJ Transportation index.

Earlier in the week I noted that the US dollar seems to be unable to sustain any momentum on the upside and the relapse yesterday in, for example, UUP should actually be seen as providing additional comfort for the equity bulls. Having said that, the forex dynamics could be subtly shifting away from the carry trade as the intraday action on Wednesday revealed just how illiquid certain sections of the market became when the funds en masse wanted to exit some currency pairs.

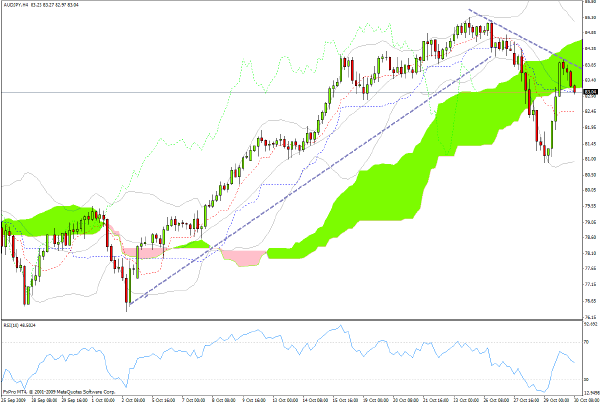

The AUD/JPY made a very swift recovery in yesterday’s North American session, although as the four-hour chart below reveals, some of that rebound was given back in overnight trading in Asia. From a technical perspective a retest of the top of the channel that I alluded to in yesterday’s commentary and during my contribution to CNBC’s European Closing Bell should be monitored closely for signs of waning enthusiasm and negative divergences. Should they appear, the likelihood would be that we need to go back towards a test of the lower channel boundary which equates to a cross rate of about 78.

Clive Corcoran is the publisher of TradeWithForm.com, which provides daily analysis and commentary on the US stock market.

|