| The Problem With Pensions |

| By John Mauldin |

Published

08/7/2010

|

Currency , Futures , Options , Stocks

|

Unrated

|

|

|

|

The Problem With Pensions

Sadly, I find myself with more than enough time to compose yet another Thoughts from the Frontline in an airport, as a flight booking error has me at JFK for six hours instead of fishing in Maine. Details for those interested or amused at the end. But it does allow me to offer you a peek into a very sobering report on how badly underfunded public pension are. The situation is worse than you think. Then we will close with a eye-opening report on China from the gracious Simon Hunt, who is allowing me to reprint his latest missive in toto. You really want to read this one. And we start with this rumor from Reuters, just in. Read this and weep. It comes from James Pethokoukis.

Political Risk: An August Surprise from Obama?

"Main Street may be about to get its own gigantic bailout. Rumors are running wild from Washington to Wall Street that the Obama administration is about to order government-controlled lenders Fannie Mae and Freddie Mac to forgive a portion of the mortgage debt of millions of Americans who owe more than what their homes are worth. An estimated 15 million U.S. mortgages - one in five - are underwater with negative equity of some $800 billion. Recall that on Christmas Eve 2009, the Treasury Department waived a $400 billion limit on financial assistance to Fannie and Freddie, pledging unlimited help. The actual vehicle for the bailout could be the Bush-era Home Affordable Refinance Program, or HARP, a sister program to Obama's loan-modification effort. HARP was just extended through June 30, 2011.

"The move, if it happens, would be a stunning political and economic bombshell, less than 100 days before a midterm election in which Democrats are currently expected to suffer massive, if not historic losses. The key date to watch is August 17, when the Treasury Department holds a much-hyped meeting on the future of Fannie and Freddie."

Normally I blow this type of stuff off. But Pethokoukis is a serious journalist with a solid pedigree and a long list of inside contacts, which you can see at the link below.

I hope this is just a rumor. Seriously. You want to tax renters (about 35% of us) to help pay for mortgages for people who entered knowingly into a business transaction that sadly did not end well? I truly feel sorry for them. I have several very good (and responsible) friends who are in trouble, and I understand the issues. They just bought at the wrong time. But what about my investment in a start-up that failed? People who are behind on credit cards? If you bought a new car, you are underwater the moment you drive the car off the lot. Help for those? Where does it end? Hundreds of billions of debt that our children will have to pay? Say it ain't so, Joe. You can read the whole blog if you have adult beverages or blood-pressure medicine nearby. http://blogs.reuters.com/james-pethokoukis/2010/08/05/an-august-surprise-from-obama/

The Problem with Pensions

A report just out from the Center for Policy Analysis, by Courtney Collins and Andrew J. Rettenmaier (solid academic types from Mercer University and Texas A&M respectively), that indicates that state and local pension funds are drastically underfunded.

I first wrote about public pension problems in 2003, suggesting that pensions would soon be underfunded by $2 trillion, as a long-term secular bear market would dampen returns. Turns out that I am once again proven to be a wild-eyed optimist. Quoting from the executive summary:

"Many state and local government pension plans' liabilities are calculated using discount rates that are not commensurate with the risk they may pose to taxpayers. Accounting standards allow pension funds to calculate their liabilities using a discount rate comparable to the expected rate of return on the funds' assets. This typically high discount rate tends to reduce the size of a pension plan's accrued liabilities. However, pensioners have a durable legal claim to receive their benefits and consequently, it is more appropriate to use a lower discount rate in calculating the plans' accrued liabilities.

"Due to the use of high discount rates, the liabilities of state and local government pension plans are underestimated. For example, recent reports by the Pew Center on the States and others indicate that assets will cover about 85 percent of the pension benefits owed to participants. But other studies that adopted lower discount rates have found liabilities may actually be 75 percent to 86 percent higher than reported. As a result, taxpayers' role as insurer may be much greater than anticipated."

You can read the whole report and see how your state is doing at http://www.ncpa.org/sub/dpd/index.php?Article_ID=19634

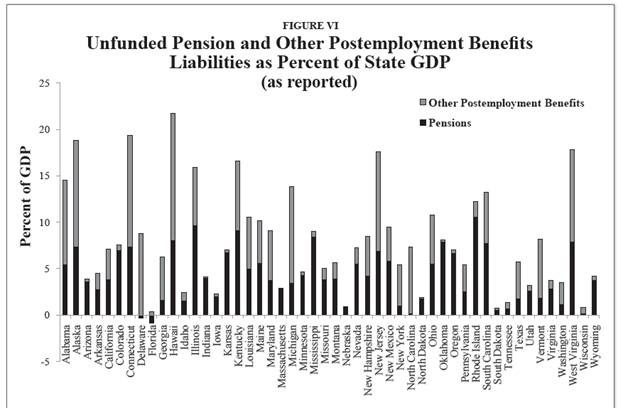

Turns out that, by the authors' calculations, state and local pensions are underfunded by $3 trillion (with a T). Of course, some states are much worse off than others. The report has numerous graphs but the following one tells us a lot. It is the unfunded liabilities as a percentage of state GDP.

In the paper (less than 20 pages) they cite the work of Novy-Marx and Rauh and another paper by Biggs. They all use very different methodologies but come up with roughly the same $3 trillion underfunding.

First, understand that in most states the law will not allow for adjustment of pensions. Taxpayers are completely on the hook. That money WILL be found at the expense of either higher taxes or reduced services (such as health care, roads, or police).

Second, the hole is getting deeper each year. Most pensions assume they are going to get an 8% return on their investments. This in a time of a slow economy for years ahead (as I have shown elsewhere), very low bond yields, and a stock market that I think is still in a long-term secular bear market for another 6-7 years, which suggests a continuation of the current sideways, volatile market.

What if instead of getting an 8% return, total returns were 5%? That would mean the hole would be getting deeper by about $75 billion a year. And what if people lived longer, as is clearly the trend, as the actuaries keep changing the longevity tables every few years for the better? (Which for this 60-year old is a very good thing!)

Why use an 8% assumption? Because if you used more conservative numbers, as the academic studies suggest, you would have to make larger current contributions to the pensions, when state and local governments and schools are already in fiscal trouble. So what do the pension plans do? They hire "consultants" who tell them they can expect 8%, as shown by all the nice models and papers that back up their "advice." Note that if you were a consultant who said you should use a 5% discount rate, you would not be hired. Hmmm, where have we seen that phenomenon before?

My friend Paul McCulley (of PIMCO, who I hope to see tonight) quipped that the ratings agencies were supplying fake IDs at a teenage drinking party, when it came to the subprime mortgage ratings. The pension consultants are providing a similar service to their clients, who are told what they want to hear, pay large fees for the privilige, and thereby increase the risk to taxpayers and reduce the current pain for politicians.

This is going to end in tears for many states and municipalities. I mean real tears. Pension funding in some states will be required by law to consume 25-30% or more of tax revenues. That is going to mean much higher taxes or reduced services. I would seriously consider checking how your state and locality are funded. You might not want to retire to a place that is on a collision course with serious pain. Just a thought.

Whither China?

Now let's turn to China. I received this report from Simon Hunt (who is based in London, and who makes my travel schedule look positively pedestrian). Besides being an expert on the copper market he is a serious student of China, travelling there often. He has developed a number of very insider contacts over the years. The more I read Simon, the more I take seriously his analysis. He is very contrarian, but he seems to be getting a lot of things right. So let's see what he has to report back from his latest visit to China.

--------------------------------------------------------------------------------

CHINA VISIT: ECONOMIC REPORT

By Simon Hunt

In all likelihood, China has entered the most critical and taxing period since the country was reopened to the outside world in the 1970s. Domestically, there are a slew of issues, any one of which could create instability. These issues include:

-- Home affordability

-- Leadership instability

-- A potential if not actual housing bubble

-- The rising income and wealth differential between those who have made it and those who have not

-- The country's continued dependence on exports as its principal driver of growth

-- Cheap credit, which punishes savings and encourages investment/speculation

-- The misallocation of capital that springs from the previous factor

-- Local/provincial government indebtedness

-- A new assertiveness and arrogance at all levels

-- Policy making that focuses on short-termism without addressing structural and longer-term issues, etc.

I-- mpact of rising wages

-- Energy intensity

-- Role of foreign companies

-- Resource dependability - water, raw materials, etc.

The list could go on, but these issues are evolving at a time when the global environment is fraught with difficulties and uncertainty, making policy making within China that much more complex. The infighting within the leadership, which goes beyond the normal tensions that often occur during the period leading up to a change in leadership (due in 2012), is making policy management more difficult and has led to conflicting views being expressed by various factions, in the media.

Few can know the full story of what goes on within the State Council, but there appears to be a battle royal being fought over the real estate sector. There are those within the leadership who are concerned that average home prices have gotten too high for most first-time buyers (see our previous visit report). They want to see average prices fall by 10-20% across the country. Against this group are not just real estate developers but local governments and many others within Beijing. This group, of course, depends for much of their revenue, or in the case of developers, their profits, on rising land and building values. In fact, local governments depend on land sales for one-third of their revenues. In 2009, land sales brought in RMB 1.6 trillion, compared with a total budget income of RMB 3.3 trillion. Moreover, land is the most-used collateral for bank loans; its value is thus crucial to the credit edifice.

Many local governments have not adhered fully to the new restrictions imposed by the central government on the real estate sector. This has infuriated those in Beijing who are determined to encourage a fall in home prices. In effect, what is being seen is a battle between central and local governments. In our view, this is a fight that central government cannot afford to lose.

The scale of speculation in real estate is enormous. There ia a total of 64.5 million apartments and houses lying purchased but vacant in urban China, about five times the surplus in the USA, according to an economist from the Chinese Academy of Social Sciences.

A report written by the National Bureau of Economic Research in July this year provides interesting data on China's housing market. Real housing prices have risen by 140% since the first quarter of 2007. In the first quarter of this year, house prices rose by a record 41%, since when it appears that prices have stabilised but not fallen. Price increases have not been driven by any shortage in housing. In five of the eight markets that the authors of the report studied, the net new number of housing units provided since 1999 was at least as large as the net increase in the number of households. In the three others, the relatively modest gap does not explain the huge rise in home prices.

In Beijing, there has been an almost eight-fold increase in land values since 2003, but since the end of 2007 land prices have nearly tripled. The impact of rising land prices on home and apartment prices has been equally great. From 2003 to 2007, the ratio of land-to-house values hovered between 30% and 40%, but since then it has doubled to just over 60%. The report also found that when a central government state-owned enterprise (SOE) was a winning bidder for land, prices rose by about 27% more than if they had not been involved, thus showing the influence that SOEs bring to bear on land values, an influence that grew in 2009 when they became more active. A separate report shows that so far this year 82% of Beijing's land auctions have been won by SOEs.

Price-to-rent values in Beijing and seven other large markets across the country have increased from 30% to 70% since the start of 2007, and current price-to-rent ratios imply very low user costs of no more than 2-3% of house value. Very high expected capital gains appear necessary to justify such low user costs of owning. The report continues with calculations suggesting that even modest declines in expected appreciation would lead to large price declines of over 40% in markets such as Beijing.

In summary, against a background of cheap money and plenty of credit, house prices across the country have become unaffordable to most first-time buyers. In Beijing, for instance, average house prices have been between 14 and 15 times incomes for the past three years, but rose to 18.5 times in the first quarter of this year. If average home prices do not fall significantly across the country, the risk is that Beijing will be forced to tighten policy another notch. A softening in monetary policy is likely only if average home prices fall within the 10-20% range.

This is what the policy fight is all about, because if these price developments continued unchecked the leadership would risk encountering social instability. Workers everywhere are demanding higher wages. The demands are not just amongst the SMEs and foreign companies, but within the SOEs. We understand that a significant number of SOEs have seen de facto strikes, just not in name. The workers clock in, go to their stations, put down their tools, and clock out without doing any work.

The list of grievances is long, with rising wages being one. How government deals with this situation remains to be seen. We were reminded that in 1989 it was only when the workers joined the students that an explosive situation developed. No one is expecting anything remotely similar, but these developments do illustrate the tensions lying beneath the surface which the leadership is having to grapple with.

Politics in China is all about maintaining social stability. The demographics of the country are forcing the leadership into a new economic model, which will be partially driven by the level of average wages over the coming five years being at least double that of the last five years.

Dr Clint Laurent of Global Demographics has consistently stated that China's statisticians have overstated the country's birth rates since 1990. This implied, as he said in a paper in 2005, that China's labour force would peak at 770 million in 2008, falling to 690 million by 2025. Another major consequence is that the important age group of 20-39 peaked in 2000 at 458 million and by this year will have fallen by 4%.

The consequences of these demographic changes are immense. First, wage inflation will be a given, not just in the private and foreign sectors but amongst the SOEs, as we mentioned earlier. Second, it means that manufacturers will introduce automated machinery to reduce the workforce (the new booming sector) and improve productivity. Third, rising wages lay the foundation for better consumer spending; though households, as in the past, will have to cover the losses racked up by local governments, according to Michael Pettis, a visiting professor in Beijing. Fourth, disposable income in the rural sector is improving. This development, combined with subsidies granted to rural households for buying a range of household appliances, has lifted the demand for these products in rural areas. Nonetheless, it is human nature that when a gift is offered there is a rush to buy, so how long the subsidies will affect sales of appliances is a moot point.

Finally, policy makers know that the time has come when the country's dependence on exports for growth must be replaced by domestically driven growth that focuses on consumer spending and not fixed-asset investment. Local coastal governments, however, will fight to see that exports from their regions continue to drive their own growth; but their success will depend on global trade.

Much of the surge in exports so far this year has been due to the replenishment of inventory within the distribution and sales channels and to the expected increase in export prices out of China. Inventory replenishment has now run its course in Europe and the USA. Given the expected slowing of consumer spending in the US in the second half of this year, some inventory liquidation might actually be seen. Even so, exports from China should weaken sharply by year-end.

The move to de-peg the RMB from the US$ gives Beijing the flexibility to either appreciate or depreciate the currency depending on global conditions. Any appreciation will be modest given the small margins that most exporters enjoy. If our profile of the world economy is even half correct, we should expect to see the RMB depreciate against the US$ and other currencies post-2012.

Wage inflation threatens to feed into general inflation. Food prices remain quite stable overall for now, but there is a risk that they will be rising by year-end. Vegetable prices are rising sharply, according to friends who shop every week. Meat prices are stable for the time being, but wheat prices had risen well above the government's sale price of RMB1800, to over RMB2350, when we last looked. Friends fear that food prices will be rising in the fourth quarter, with some economists predicting that CPI will be increasing at a 5% rate by then. We are told also that the cost of getting an electrician, plumber, etc. in to do odd jobs has doubled over the last year in Beijing and other major cities. Our general take is that China is on the threshold of seeing an overall increase in the cost of living. Whether it shows up in official numbers or not, households will feel it.

A long-term concern is whether China has key resources to maintain the growth profile that the country has experienced over the last 40-odd years. Water may well be a key constraint. China's water-resource capacity is only Ã,¼ of that of the world average. In other words, the country has 20% of the world's population but only 7% of global water resources. The problem is compounded by the dispersion of those resources. The area around the Yangtze River accounts for 36.5% of the country's land mass, but holds 81% of its water. North of the Yangtze River lies 64% of the country's territory, but only 19% of its water resources.

A World Bank report shows that more than half of China's 660 cities suffer from water shortages; and 90% of cities' groundwater and 75% of their lakes and rivers are polluted. These are examples of the physical constraints on growth. China's rapid pace of industrialisation has left the country with severe burdens and a massive clean-up, not just in urban areas but throughout the countryside. Water is a global depreciating resource, as William Houston and Robin Griffiths showed in their book Water: The Final Resource. History also shows that wars are fought over access to water.

Local government indebtedness is being exposed as a potential time-bomb, as one friend remarked to the writer. Whatever the correct figure, it is large and is in the range of RMB6 trillion to RMB11.4 trillion, equivalent to 71% of the country's nominal GDP. Some reports suggest that banks will have difficulty recouping about 23% of what they have loaned out. The China Banking Regulatory Commission has told banks to write off nonperforming project loans by the end of this year.

No one should be surprised by these numbers. Back last October we were told - and we reported - that one-third of the fiscal stimulus and bank lending never went into the real economy. There are likely to be more hidden black holes. One consequence is that credit is tight, with receivables mounting across a wide swath of manufacturing.

Markets will sense some of these uncertainties. In line with falling global equity markets, which should start very soon, the Shanghai and other Chinese stock markets are likely to fall sharply by year-end. This will take the stuffing out of consumers' willingness to buy large-ticket items like cars and appliances. Already, so we hear, inventories of these items are growing within the distribution systems, with production levels likely to fall over coming months.

Many companies believe that the weakness now being seen is seasonal. But others, whose opinions we respect, believe that weakness will be seen at least until year-end. Prices of raw materials, semi-fabricated products, and finished goods are likely to start falling very soon. Instead of accumulating inventory, stocks within the entire manufacturing and distribution systems will be slashed, repeating to a lesser degree what occurred in the second half of 2008. Construction activity will continue to slow, notwithstanding the continued high rate of completions, consumer spending will slow also, exports will be weak in the fourth quarter, and growth of fixed-asset investment will be lower. By year-end, the psychology of businessmen and consumers will have shifted from optimism towards pessimism in line with movements in the Shanghai stock market. Real business activity will be pretty flat in the fourth quarter. The latest PMIs from the Government's Logistical Office and from the HSBC both indicate a slowing economy. The former is geared more to the SOEs and the latter to the private sector. The HSBC sub-index of new orders fell from 49.7 in June to 47.9 in July.

In summary, we doubt there will be any easing of policy until average house prices fall into the 10-20% range. China is transiting into a very difficult period as focus shifts towards sustainable domestic growth and away from short-term measures to defend the 8% GDP mantra. This transition is occurring when the existing leadership is preparing to give way to the new set in 2012, when social stability could be threatened if there are policy mistakes, when the rest of the world is starting to stand up to China's increasing assertiveness, and when foreign companies are questioning their future in China. China will muddle through, but it won't be an easy ride.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.

|

|