- Market: January 2006 Dow Jones Industrial Average (DJH6) Jan. Dow options trades based on the the March Futures contract.

- Tick value: 1 point = $10.00

- Option Expiration: 01/20/06

- Trade Description: Bull Call Butterfly Spread

- Max Risk: $500

- Max Profit: $1500

- Risk Reward ratio 3:1

Buy one January 2006 Dow 11,000 call, sell two January Dow 11,200 calls, and buy one January Dow 11,400 call. For a combined cost and risk of 50 points ($500) or less to open a position.

Technical/Fundamental Explanation

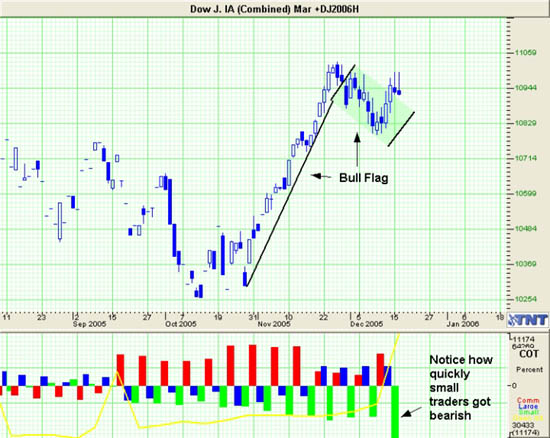

The stock indexes have done a good job of staying up this year. While they haven't really rallied much the fact that they did not break down in the face of many bad stories this year should not be ignored. I have been a bear for most of 2005 and it has not worked out for me. I am now officially switching to the bull camp. First on a technical level the Dow has been forming a rather strong bull flag now for the last month or so. In the last two weeks the commitment of traders report shows that the overall short position held by small speculators has doubled in size. In other words they went from being bearish to being extremely bearish in a weeks time. This is not normal and even if the market had been poised to move lower, with this many small traders holding shorts you can bet that a rally is near. Also seasonal's show a strong bias towards a rally in the first few weeks of the new year. And since the bears are clearly in hibernation I must advise that we go long.

Profit Goal

Max profit assuming a 50 point fill is 150 points ($1500) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with Dow trading at 11,200. The trade is profitable at expiration if it is trading any where between 11,050 and 11,350 which means we have a band of 300 points on the Dow that we can profit in!

Risk Analysis

Max risk assuming an 50 point fill is $500. This occurs at expiration with the Dow trading below 11,000 or above 11,400.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.