| The Bang! Moment Is Here |

| By John Mauldin |

Published

06/17/2012

|

Currency , Futures , Options , Stocks

|

Unrated

|

|

|

|

The Bang! Moment Is Here

"Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence -- especially in cases in which large short-term debts need to be rolled over continuously is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang, confidence collapses, lenders disappear, and a crisis hits.

"Economic theory tells us that it is precisely the fickle nature of confidence, including its dependence on the public's expectation of future events, which makes it so difficult to predict the timing of debt crises. High debt levels lead, in many mathematical economics models, to "multiple equilibria" in which the debt level might be sustained � or might not be. Economists do not have a terribly good idea of what kinds of events shift confidence and of how to concretely assess confidence vulnerability. What one does see, again and again, in the history of financial crises is that when an accident is waiting to happen, it eventually does. When countries become too deeply indebted, they are headed for trouble. When debt-fueled asset price explosions seem too good to be true, they probably are. But the exact timing can be very difficult to guess, and a crisis that seems imminent can sometimes take years to ignite."

From This Time Is Different, by Carmen Reinhart and Ken Rogoff

We know that money is simply flying out of Greek banks. A number of them are clearly insolvent, yet they are meeting demands for withdrawals. Where is the cash coming from? The answer is in the form of yet another acronym from Europe, called the ELA. Is there a limit to this largesse? And politicians are becoming rather snarky (short-tempered, critical, testy, irritable, freaked-out -- you fill in the word) with each other. This is what happens when crisis-weary politicians face yet another Greek tragedy, but this time perhaps it will hit even closer to home. Is there anyone left anywhere who has not grown tired of reading about Greece? I am tired of writing about them, yet if we are to understand the sturm und drang, the storm and stress, of Europe, we must begin there. Because, unlike Las Vegas, what happens in Greece most definitely does not stay in Greece.

The ECB Explained

Let's begin with a little primer on the European Central Bank. I had a rather lengthy discussion on this topic with David Kotok over the last few days, as he really does spend too much time delving into great detail about what is arcane trivia to most of us. It is great, though, at times like this to have someone patiently explain the inexplicable. I thank him for the accurate details and analysis in the next few pages and assume all responsibility for errors or problems.

It is quite easy to write about the ECB as if it is the mechanism by which money is printed in Europe, but that is only partially true. The ECB is governed by a board. In reality, the ECB is more like the FOMC (Federal Open Market Committee) of the US Federal Reserve. The ECB meets and sets policy, and then that policy is acted upon by the various central banks of the member nations.

Likewise, while it is convenient to think about "the Fed" printing money and buying and selling bonds in its daily operations, in actuality it is the New York branch of the Federal Reserve that does the open-market transactions, carrying out the policies of the FOMC.

So when the ECB decides to authorize one trillion euros to be made available to banks in Europe, such as in the recent LTRO (long-term refinancing operation), it is actually the various national central banks that do the transactions for their in-country banks. Under the LTRO, the ECB sets the policy and the nature of what qualifies as collateral for the loan, what type of "haircut" is set for the collateral, and so on. The ECB takes the risk of any loans it authorizes, rather than the national central banks. For the recent LTRO, the interest rate was set very low, and the recipient banks could then turn around and lend the money to customers or buy government bonds.

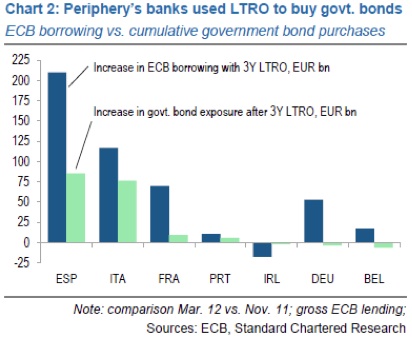

Spain was by far the country whose banks took greatest advantage of the cheap money, with Italy coming in second. While the banks of other countries used the money to do other things than buy government debt, the banks of Spain and Italy borrowed at 1% and bought their own government bonds, paying a great deal more, as the chart below shows (courtesy of Alphaville).

Before we move on, let me note that there are calls for the ECB to do another LTRO as a way of injecting more liquidity into the system. While I expect the ECB will indeed find some way to fund banks, the last time around they took collateral (basically, loans to customers) that was rather at the risky end of the spectrum. I wonder how much good collateral is left in countries like Spain? How far out the risk spectrum is the ECB willing to go? That money will flow is clear; I am just not certain of the mechanism. If they do another LTRO-type funding, it may be for a smaller amount. I am certain they would be doing an assessment of just how much demand and good collateral there is, before they would do it.

How to Prevent a Bank Run

When the eurozone was being planned, the politicians decided they did not want to create something like the FDIC we have in the US. They did not want to guarantee the deposits of banks in member countries. There were a number of reasons for this. Some countries have huge banking sectors, and other countries did not want to guarantee deposits over which they had no control. Just as the FDIC and various national agencies regulate US banks, such a eurozone-wide system would also mean eurozone-wide regulation. Would German and French banks want to give up their relative independence? The answer was no, so each country is responsible for regulating and guaranteeing its own banks.

So the technocrats then pondered the problem of how to prevent a bank run at the country level. The answer was something called Emergency Lending Assistance, or ELA. Basically, the ECB authorizes the various national central banks to make money available to banks that are having cash problems, but with the understanding that the debt is the responsibility of the national central bank and its government. At the time, something like a LTRO was not written into the plan. ECB president Mario Draghi (or someone at the ECB) basically created the concept and got the board of the ECB to go along with it.

While the US Fed is relatively transparent in its actions and balance sheet (compared to other central banks), the ECB is rather secretive about the ELA. "You don't say when you are in an emergency situation, because then you make the situation worse. So I really don't see the usefulness of being more transparent," Luc Coene, Belgium's central bank governor, explained in a Financial Times interview this month.

At one point the amount of ELA money was a separate, identifiable item on the ECB balance sheet, but now the numbers are buried in the "other" category. But since "other" has skyrocketed in the last year, we can guess about the amount. The Financial Times reported that it was about 150 billion; but there is reason to believe that over �200 billion has been lent as of this week, as Greece and other countries are really getting serious. (Note: the balance sheet of the ECB includes the collective balance sheet of the national central banks.)

I am sure the people who dreamed up the ELA would be shocked at such a number. But then they did not anticipate the debt crisis that would be caused by the euro either. You can see the rise in the "other" category in the chart below (courtesy of Alphaville):

Now, this is an important point to understand. The various national governments are authorized to create euro loans to their banks in times of "emergency." So Greece (through its national central bank) has the ability to print euros. When the ECB denied access to LTRO money to (I think it was four) Greek banks because of inadequate collateral, they immediately turned to the Greek Central Bank and got all they wanted. In theory they are paying a much higher interest rate, but that does give them access to cash to allow customers to withdraw their money. And while it is hard to say there is a "run" on Greek banks, the pace is up to a pretty steady trot. Over 600 million a day is leaving the Greek system. Given that there is only about 150 billion left, that is about 2% of deposits a week. More on that later.

While researching this late at night, I stumbled upon this rather well-written piece from Thomas Warner. Let's jump to part of his conclusion. You can read the whole piece at http://seekingalpha.com/article/619341-how-greece-will-drag-down-europe-and-refuse-to-leave.)

The Distant End Game

"All folly must end eventually. Greece's ELA folly will end with the cash gone abroad and the collateral turning out worthless.

"Along the way, the rest of Europe will grow increasingly nervous. ELA loans are guaranteed by the Greek central bank, which is in turn guaranteed by the Greek government. And the Greek government already can't pay its debts without help from the rest of Europe.

"As the pile of ELA loans grows, northern European governments will likely begin agitating for limits to be placed on Greek use of ELA, or to cut it off altogether. If the Greek government threatens to default on its debts to Europe, the question of cutting off Greek ELA would likely be raised at the same time.

"But in the periphery and in France, there will be voices for leniency. A vote to cut Greece off from ELA would be a vote to force its banking system to shut down. That would send a very frightening message to depositors in Spanish, Italian, Irish and Portuguese banks, and could create a European-wide bank run.

"It requires a vote of two-thirds of the Eurozone's national central bank governors to restrict a country's use of ELA, so Greece would need only five allies to block.

"My guess is that compromises will be made, and though Greece ELA might be progressively limited, it will never be cut off entirely. Likewise, Europe is likely to suspend aid-loan disbursements from time to time, but then negotiate last-minute compromises before Greece gets to the point of defaulting on its debts.

"Eventually, Europeans will realize that the losses of the Greek banking system have been foisted on them, bit by bit, ELA loan by ELA loan.

"There is no way Greece can ever be forced to pay for the banking losses that it is monetizing through ELA. The money is going to private parties' accounts at mostly German banks. The bad assets are hanging slightly over the Greek central bank's balance sheet, ready to be dropped there in a big, stinking pile as soon as Greek banks are cut off from central bank financing.

"One way or another, the rest of Europe will end up paying for the clean-up. The only question will be whether to pay pro-actively through another, bigger Greek bailout with repayment pushed further into the future, or to pay by cutting Greece off from ELA, forcing Greek banks to shut down, and then having to replenish ECB capital wiped out by Greece's inability to make good on its guarantees of ELA loans."

There is about 240 billion in loans in Greek banks, which could fund ELA money if the Greek central bank was lenient with its definition of qualified collateral and haircuts. In theory, under the current authorization the Greek central bank could fund the withdrawal of every deposit in every bank in Greece, leaving no deposits. And they could continue to do it until the ECB voted to cut up their credit card. This, as Thomas points out and David agrees will not happen, because that starts a bank run in Spain and Portugal the same day! And the following week in Italy?

And that is one of the reasons why anyone who understands this system is nervous about this weekend. If the Greek give the relatively radical-left party Syriza the largest share of the vote, the amount of money leaving Greece will escalate quickly, as the danger of returning to the drachma will increase. Given the rhetoric on both sides, there could be a dramatic increase in risk.

But will the ECB unilaterally cut off Greece from ELA funds? I rather think not. There is little question that cutting off ELA would push Greece out of the eurozone. Rather, the ECB will wait (appropriately in my opinion) for the political authorities to act. This is not an issue to address with monetary policy. Draghi said as much in a recent interview. While he would prefer Greece to stay in the eurozone, that is a decision for the political policy makers.

A final thought about Greece and implications for the rest of Europe. Money leaving Greek banks is money that is not invested in Greece businesses. Cash has no multiplier. It is the opposite of high-powered money. It is deflationary.

A run on banks makes it much more difficult to recover, especially of an economy is reduced to cash and barter. Greece is tragically short of medicines and needed medical supplies. It is dangerously close to losing access to energy markets. I would say Greece is ripe for a military coup, but if your military personnel can go on strike (which some of them have!) that does not actually inspire confidence in their power.

Greece is going to need massive amounts of aid and bailouts and loan forgiveness. And yes, Spain looks like Greece did three years ago, except with a worse-off economy and a banking crisis. Spanish and other European politicians are saying the same things about Spain that were said about Greece three years ago. And that is why Greece matters. If Greece is cut off, then the markets will ask, "Who is next?"

The Bang! Moment is Here

Let's review that quote from This Time Is Different:

"Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence � especially in cases in which large short-term debts need to be rolled over continuously is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang! � confidence collapses, lenders disappear, and a crisis hits.

"Economic theory tells us that it is precisely the fickle nature of confidence, including its dependence on the public's expectation of future events, which makes it so difficult to predict the timing of debt crises. High debt levels lead, in many mathematical economics models, to "multiple equilibria" in which the debt level might be sustained � or might not be. Economists do not have a terribly good idea of what kinds of events shift confidence and of how to concretely assess confidence vulnerability. What one does see, again and again, in the history of financial crises is that when an accident is waiting to happen, it eventually does. When countries become too deeply indebted, they are headed for trouble. When debt-fueled asset price explosions seem too good to be true, they probably are. But the exact timing can be very difficult to guess, and a crisis that seems imminent can sometimes take years to ignite."

I think the time is rather close. Spain cannot borrow the money it needs to bail out its banks at a rate it can afford and has in effect been shut out of the bond market. Spain is going to need not just a bailout for its banks but also to restructure its debt and/or default on some of it. That is just the math. And when Spain needs that money, the market will get very nervous about Italy. And we mustn't forget Portugal; it will need debt forgiveness as well. Oh, and Ireland.

German Chancellor Merkel this week warned that the policies of the new Socialist French president, Francois Hollande, could destroy the eurozone by bringing the sovereign debt crisis to France itself.

"As tensions within the eurozone deepened on Friday, the German chancellor dismissed 'quick fixes' and refused to consider any discussion on pooling debt for eurobonds or Germany underwriting bank deposits in other eurozone countries. She hit out at Mr Hollande for blocking EU supervision of national spending and supporting eurobonds, which she warned would 'mask' divergences between Germany and 'mediocre' or declining eurozone economies, such as that of France. 'If you look at the development of unit labour costs between Germany and France, differences have now been growing a lot more strongly, a topic that must be discussed,' Mrs Merkel said." (The Telegraph)

There is a summit coming up in a few weeks. Gordon Brown, former prime minister of Britain, said that the "standard but often empty" plans usually agreed to at such summits will "not do when the euro area is finally approaching its own day of reckoning." He warned that the crisis threatens to spread and lead to Italy and even France requiring bailouts. Rather unusual for a former PM.

If France loses its AAA rating, then the pressure would be on Germany to do the really heavy lifting. Merkel realizes that and will put pressure on Hollande to back off from his campaign promises, before he risks that rating and the entire eurozone experiment.

It appears that Merkel is ready to accept a serious fiscal union and central budget controls, but strict guidelines and a much more specific treaty will be conditions for German acceptance. In a speech to supporters this week, Merkel said it was a mistake not to have done a fiscal union 15 years ago � a rather new position for her. The unspoken quid pro quo will be to implement labor and other reforms in the weaker countries and so narrow the gap in productivity and competitiveness between them and Germany. She will look to directly connect every transfer payment and guarantee that Germany will inevitably have to give, to the shifting of control of fiscal authority to Brussels.

But the question is time. Europe does not move without a crisis. As Jean Monnet himself said, "People only accept change in necessity and see necessity only in crisis."

And to negotiate the terms Merkel, will want will take a lot of time, something that the markets may not want to give her.

Europe is down to two choices. Either allow the eurozone to break up or go for a full fiscal union with central budget controls. The latter option ultimately means eurobonds and a central taxing authority. It also means that national labor unions will cede control to technocrats and politicians in Brussels. And that will mean the changing of labor laws. Will Europe blink when faced with central control and a European parliament that really makes a difference?

The rest of Europe is watching Greece implode. Spain has almost 25% unemployment. Italy has rejected basic labor reforms. The entire continent seems to be in denial.

Investors in bonds expect to get paid back. That is a very simple concept. And if investors worry about getting paid back, they ask for higher interest or simply walk away. There are other places to put money to work. Like Switzerland. Apparently, entire segments of European citizenry seem to think that government funding is a fundamental right, something that comes with no strings attached. "Give me what I want in terms of pensions and work. And health care. Protect me from change and market forces in my job. And tax someone else, preferably someone else who has more than I do, so I can enjoy all these benefits."

There is a limit to how much debt the market will be willing to tolerate. What that limit is, no one actually knows until it is reached, and then it is too late. The limit has evidently been reached now in Spain. It will soon be "now" in Italy and even France, minus serious reforms. German credit default swaps are rising every week.

But just as there is a limit to the bond market's willingness to fund debt, there is a limit to voters' patience and willingness to bear pain. That frustration grows when there seems to be no end in sight to the pain on the current path. But can changing course actually make things worse? The answer is, of course, yes. I am reminded of that famous line uttered by Queen Victoria, when she was informed that things must be made to change.

"Why do we need change, my dear sirs? Aren't things bad enough already?"

But change is coming to Europe. One way or another, a new order and a new balance will be forced upon them. Either a fiscal union or break-up. They have kicked the proverbial can down the road until it will roll no more. You can feel the Bang! moment arriving. This is the Endgame.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.

|

|