- Market: February Crude Oil (CLG6)

- Tick value: 1 point = $10.00

- Option Expiration: 01/17/06

- Trade Description: Bear put ladder Spread

- Max Risk: $500

- Max Profit: $2500

- Risk Reward ratio 5:1

Buy one February 2006 Crude Oil 56 put, sell one February Crude Oil 53 put, sell one February Crude Oil 52 put, and buy one February Crude Oil 49 put. For a combined cost and risk of 50 points ($500) or less to open a position.

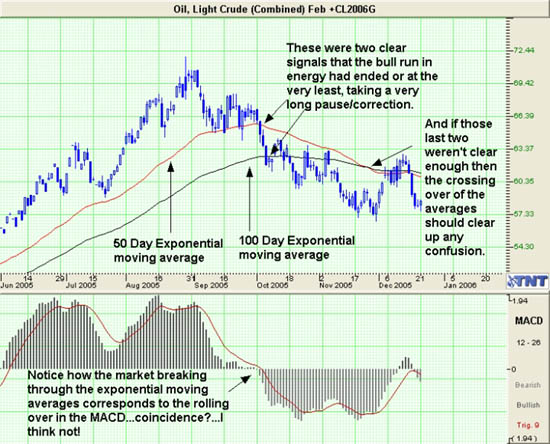

Technical/Fundamental Explanation

The sell off in the Crude market last week showed it's reluctance to continue trading on fear alone. With successive bearish inventory reports for Crude week after week, the consensus seems to be that supplies for Crude are going to be plentiful in the months to come. That being said, the products (Unleaded and the Distillates including Heating Oil) have been plagued with a much different supply picture.

The declining Distillate inventories are attributed to the colder than average temps across the Northeast U.S. resulting higher than normal demand for this time of the year. These temps are expected to subside over the next couple of weeks and put the brakes on the recent spike in demand. This should allow the quickly recovering refineries to catch up and get back to more normalized supply levels.

At this point the energy markets look as if they are staging a last gasp to the upside before resuming the downtrend that began in late August. This trade allows us to take advantage of the recent bounce and position a bear put spread only a couple of dollars out of the money while giving a $6.00 range to make a profit.

Profit Goal

Max profit assuming a 50 point fill is 250 points ($2500) giving this trade a 5:1 risk reward ratio. Max profit occurs at expiration with Crude Oil trading between $53 and $52 per barrel. Break even at expiration occurs at 55.50 and 49.50 which means that we have a band of $6.00 on Crude Oil that we can profit in.

Risk Analysis

Max risk assuming a 50 point fill is $500. This occurs at expiration with the Crude Oil trading below $49 or above $56.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.