- Market: March Lumber (LBH6)

- Tick value: 1 point = $110.00

- Option Expiration: 02/28/06

- Trade Description: Bull call ladder spread

- Max Risk: $550

- Max Profit: $1650

- Risk Reward ratio: 3:1

Buy one March Lumber 370 call, sell one March Lumber 390 call, sell one March Lumber 410 call, and buy one March Lumber 430 call for a combined cost and risk of 5 points ($550.00) or less to open a position.

Technical/Fundamental Explanation

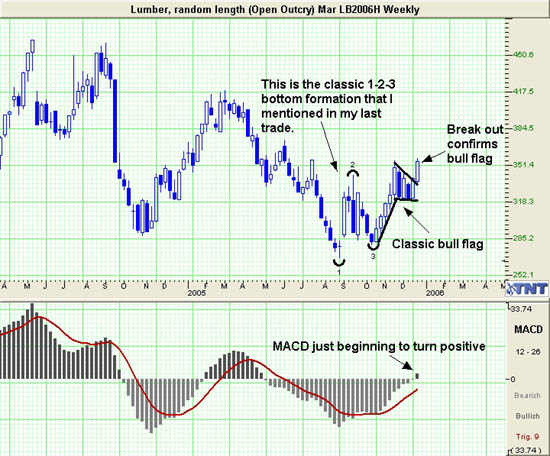

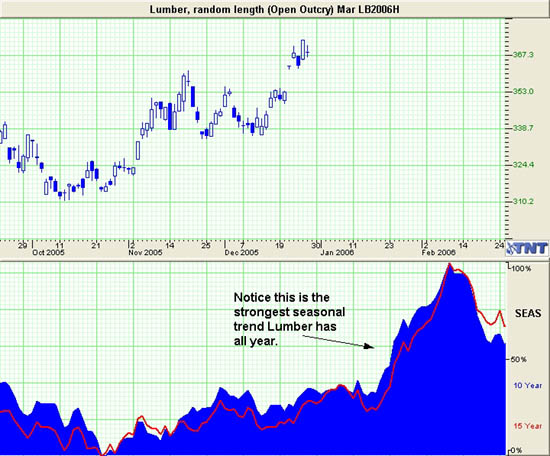

If you recall I recommended a very similar trade to this back on 10-30-05. We exited that trade today for max profit. I am now recommending rolling some of those profits back into this market again on the bull side. The charts below should explain why I continue to be bullish. The first chart is a weekly chart and the second chart is daily. Classic technical analysis says that when a bull flag is formed and then confirmed, like we are seeing on the weekly chart below, a person can estimate how far the next leg of the move should go. This is done by simply measuring the points that make up the flag pole and then adding them to the breakout point to give you your target. In this case that would be as follows: The bottom of the flag pole is at lumbers 10-14-05 low of 278.70, the top being at the 11-18-05 high of 355.30. 355.30 - 278.70 = 76.6 points. If we then add those 76.6 points to the break out point of 355.30 we get a target of 431.90. This may seem far fetched to some traders but remember lumber loves to move limit up or down for many days in a row. So just a few of those days could have us at or near 400 very soon. Also notice the seasonal strength on the second chart below. This is lumbers strongest period of seasonal demand. Significant resistance lies around the 418 level and I do think that will hold in the short term. All in all this trade give you a chance to continue to participate in lumbers rally while defining risk and keeping costs low. Traders that were in my last lumber trade should put on two of these trades for every one of the 10-30-05 lumber trades that you were in.

Profit Goal

Max profit at expiration and assuming a 5 point fill is 15 points ($1650) and occurs with Lumber trading anywhere between 390 and 410. Break even points at expiration are 375 and 425. This means we have a huge 50 point range that this trade can profit in. If the market expires anywhere between 375 - 425 we make money, and if it expires anywhere between 390 - 410 we make max profit. So we have a 50 point profit band of which 20 points are the max profit band.

Risk Analysis

Max risk is the cost of the trade assuming a fill of 5 points ($550.00). This occurs at expiration with March Lumber Trading above 430 or below 370.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.