| The Wagner Daily ETF Report For September 14 |

| By Deron Wagner |

Published

09/14/2012

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 14

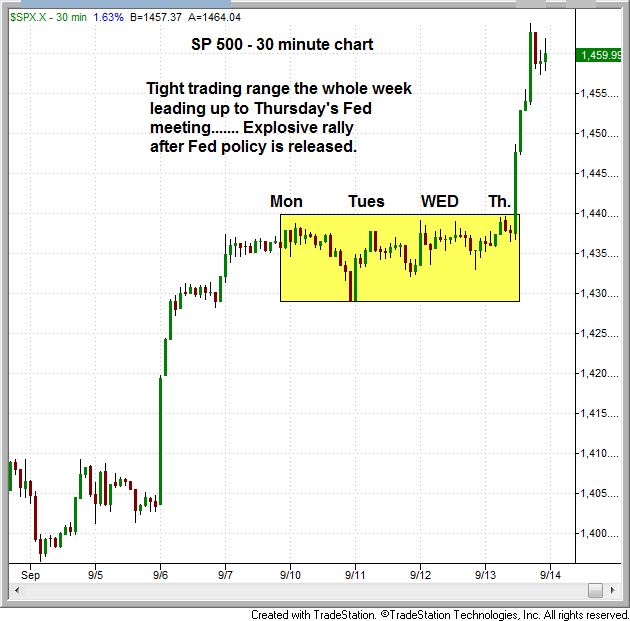

After dull week of trading, the market exploded higher in the afternoon session in reaction to Thursday's Fed meeting (see chart below):

The S&P 500 closed up 1.6% with the Dow Jones Industrial Average ($DJIA) and Nasdaq Composite close behind at 1.5% and 1.3% respectively. The small and midcap averages were slight laggards at 1.3% on the Russell 2000 and 1.0% on the Midcap S&P 400.

Thursday's move was confirmed by heavy volume and solid internals. NYSE volume came in well above its 50-day average and 30% above the prior day's level. NYSE advancing volume out paced declining volume by a healthy 9 to 1 margin. Nasdaq volume also finished above the 50-day average and 11% above Wednesday. Nasdaq advancing volume beat declining volume by a respectable 3 to 1 margin. The market volume pattern remains bullish, as institutions were actively buying on Thursday.

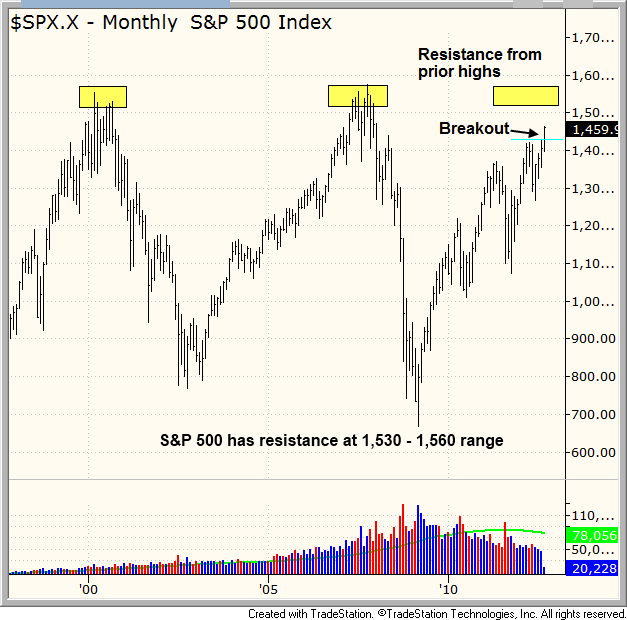

How much room do the major averages have to run before hitting resistance? Let's run through the monthly charts to get an idea of what to expect:

The S&P 500 monthly has a bit of room to run before hitting resistance of prior highs. The prior highs are obvious levels of resistance, so the current rally could easily overcut those highs before stalling out.

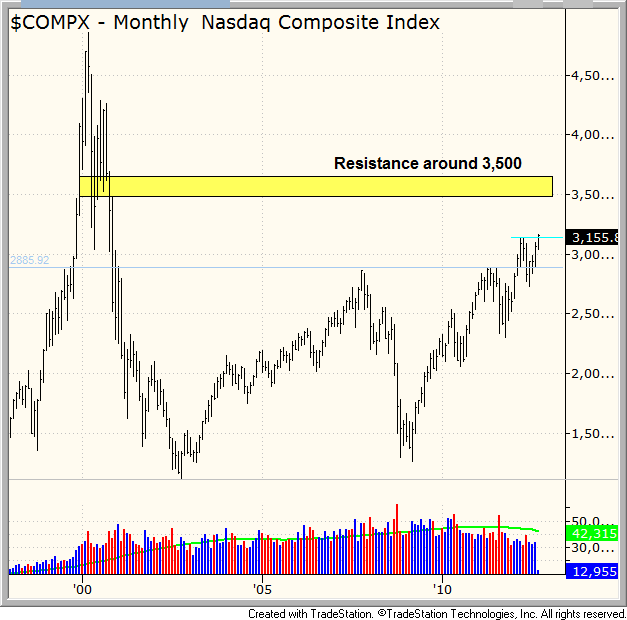

Unlike the S&P 500, the resistance is not as concrete with the Nasdaq, as it has never fully recovered after selling off from the highs in 2000. There is some resistance at the 3,500 level.

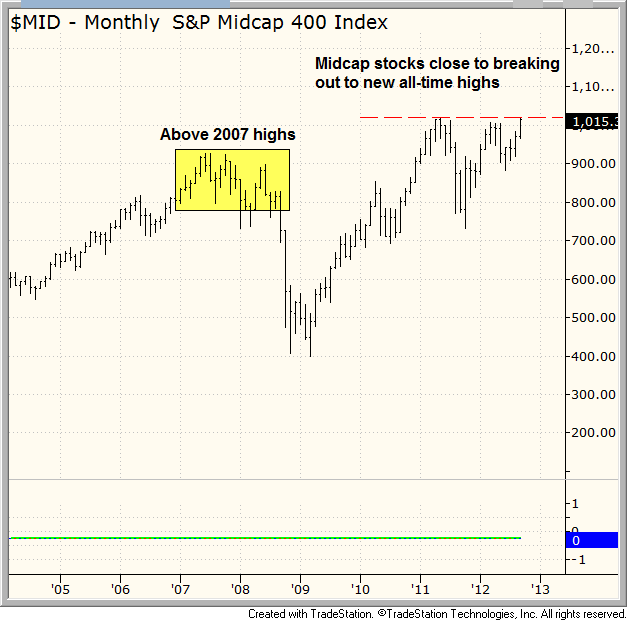

The Midcap S&P 400 is in the best shape of all the major averages. The monthly chart has already cleared the prior highs of 2007 and is poised to breakout to new all-time highs should the current market rally remain healthy. Midcap stocks have lagged the S&P 500 most of 2012 but have outperformed big cap stocks the past few weeks.

The market rally continues to pick up steam with more groups participating in the advance. The financial sector has picked up some momentum the past few weeks with the Financial Select SPDR ETF ($XLF) breaking out from a six month base on Thursday. Although there are plenty of negatives out there to keep traders from investing in this market we prefer to focus on the price and volume action and trade what we see, not what we think. Our timing model remains in buy mode and we'll continue to monitor setups for low risk entry points.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|