| The Wagner Daily ETF Report For October 16 |

| By Deron Wagner |

Published

10/16/2012

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For October 16

Stocks gapped higher on the open but immediately sold off, sending the major averages about 0.5% lower during the first ninety minutes of trading. However, unlike the past several sessions, buyers finally stepped in during the lunchtime doldrums and once again in the final hour of trading to push indices to new intraday highs at the close. All broad based averages closed with a gain in the 0.6% to 0.8% range, with the S&P 500 ($SPX)and S&P Micap 400 ($MID) showing the most impulsive price action intraday. The Nasdaq Composite was a laggard in terms of price action intraday, as it only managed to extended past the morning high in the last fifteen minutes of trading. The positive close snapped a six session losing streak in the Nasdaq Composite.

Turnover increased on both exchanges, which is good news for a market that prior to today had not seen an accumulation day in two weeks. Total volume in the NYSE was 9% higher than the previous day's level, while volume surged by 2% in the Nasdaq. In both the NYSE and Nasdaq, advancing volume beat declining volume by a decent 2.5 to 1 margin. Monday's price and volume action was a step in the right direction, but the market still has plenty of work to do to establish an intermediate-term bottom.

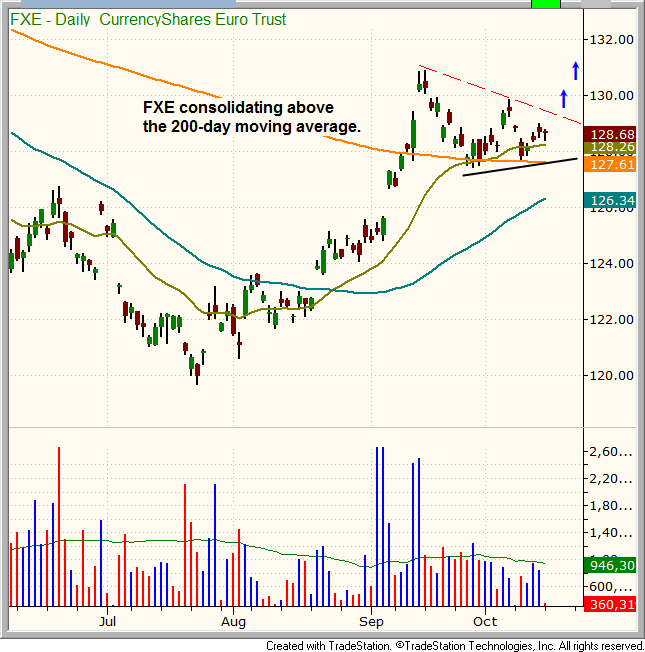

After a strong run up off the summer lows, CurrencyShares Euro ($FXE) is now consolidating in a tight range above the 200-day moving average. $FXE should continue to set higher swing lows within the base, which would be a bullish sign. In terms of moving average confirmation, although we would prefer to see the 50-day MA above the 200-day MA, the 50-day MA is sloping higher over the past month. We will continue to monitor the action over the next few days for low risk entry point.

We remain long the First Trust ISE Revere Natural Gas ETF ($FXG) from a pullback buy entry on September 27. The price action has been trading in a tight range the past few weeks and has shown relative strength by setting higher swing lows while the market sold off. Monday's bullish reversal candle on higher volume may have scared off some of the weak longs. A move above Monday's high could spark the next breakout attempt above the current range high.

Although we do not have a position in the United States Oil Fund ETF ($USO), we continue to monitor the price action along with stocks such as $AAPL and other indicators to gauge the health of the current market rally. If $USO suffers further technical damage and is unable to hold the 32.50 swing low, then a test of the June lows may be in order. A breakdown in $USO could signal that the market may see further weakness before an intermediate-term bottom is in. Again, this is just one of many tools in our arsenal to help confirm broad market price action. It is not a stand alone indicator.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|