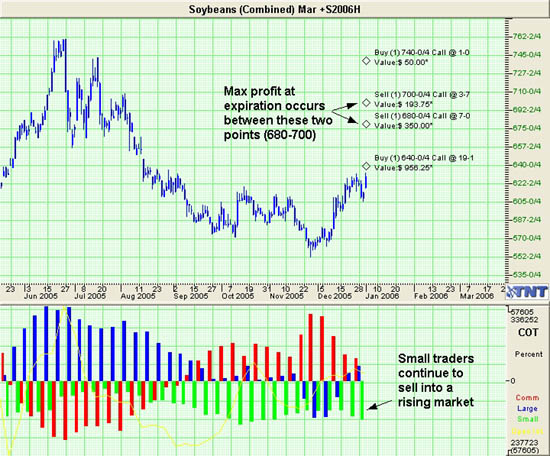

- Market: March 2006 Soybeans (SH6)

- Tick value: 1 cent = $50.00

- Option Expiration: 02/24/06

- Trade Description: Bull Call Ladder Spread

- Max Risk: $500

- Max Profit: $1500

- Risk Reward ratio 3:1

Buy one March 2006 Soybeans 640 call, sell one March Soybeans 680 call, sell one March Soybeans 700 call, and buy one March Soybeans 740 call. For a combined cost and risk of 10 cents ($500) or less to open a position.

Technical/Fundamental Explanation

The grain complex is back in play in full force. After a sleepy second half of 2005, grains have awakened from their slumber with a bang. Current Commitment of Traders reports show that small speculators continue to have a large net short position on in almost every grain that we trade. As I have said many times in the past..."when everyone agrees on something you can bet that the crowd is wrong." Continued hot and dry weather in Argentina has been one of the catalysts of the rally we have seen so far. Remember, it is summer in the southern hemisphere right now. We have seen large funds increasing long positions, while small traders do the opposite ...which leads me to one question...do small traders like you and I know something that big fund managers don't? Not likely. With small traders holding that many short positions I smell a short squeeze coming in the near future. Technically soybeans should find some over head resistance as it approaches $7.00 which is our target for this trade. Overall this is one of the lowest risk ways we could be long this market for the next 50 days or so while maintaining a 3:1 risk to reward ratio and being very near the money in our long option.

Profit Goal

Max profit assuming a 10 cent fill is 30 cents ($1500) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with Soybeans trading between 680 and 700. The trade is profitable at expiration if soybeans are trading any where between 650 and 730(breakeven points) which means we have a band of 80 cents in Soybeans that we can profit in.

Risk Analysis

Max risk assuming an 10 cent fill is $500. This occurs at expiration with the Soybeans trading below 640 or above 740.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.