- March 2006 Wheat (WH6)

- Tick value: 1 cent = $50.00

- Option Expiration: 02/24/06 March -- 01/27/06 February

- Trade Description: Calendar Strangle

- Max Risk: $400

- Max Profit: $1100

- Risk Reward ratio 3:1

Buy one March 2006 Wheat 360 call, sell one March Wheat 390 call, and buy one February Wheat 330 put. For a combined cost and risk of 8 cents ($400) or less to open a position.

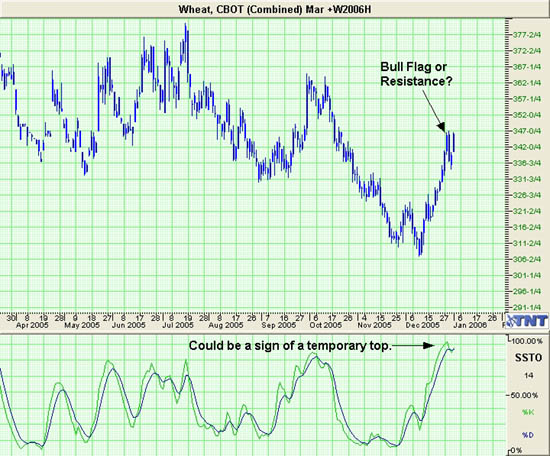

Technical/Fundamental Explanation

As I mentioned in my Soybean trade from earlier today, the grain complex is back in play in full force. Wheat has so far been the second strongest grain (Oats is the strongest). While I remain bullish there are some signs that a short term pull back may be coming. With that in mind I am recommending a short term put coupled with a longer term call spread. This combination allows us to profit from either a short term pullback or a continuation of the rally. We really don't care which direction wheat goes as long as it goes somewhere.

Profit Goal

Max profit assuming a 8 cent fill is 22 cents ($1100) giving this trade about a 3:1 risk reward ratio. Max profit occurs at expiration with Wheat trading above 390 or below 310. The trade is profitable at March's expiration if Wheat is trading any where above 368 (break even point).

Risk Analysis

Max risk assuming an 8 cent fill is $400. This occurs at expiration with the Wheat trading below 360 or above 330.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.