- Market: February 2006 Euro Currency (ECH6) Feb. Options trade based on the February futures price.

- Tick value: 1 point = $12.50

- Option Expiration: 02/03/06

- Trade Description: Bull Call Ladder Spread

- Max Risk: $275

- Max Profit: $975

- Risk Reward ratio 3.5:1

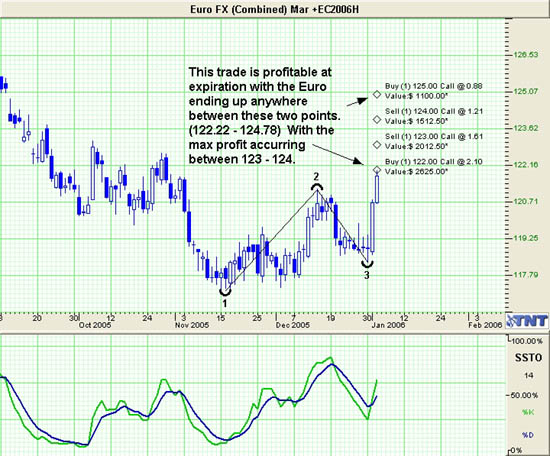

Buy one February 2006 Euro Currency 122 call, sell one February Euro Currency 123 call, sell one February Euro Currency 124 call, and buy one February Euro Currency 125 call. For a combined cost and risk of 22 points ($275) or less to open a position.

Technical/Fundamental Explanation

We just exited our January Euro Currency bull call ladder spread today for roughly a 225% return on the risk in 29 days. I continue to be bullish this market, and recommend banking the profits, and at the same time rolling our original investment from the Jan. trade right back into this Feb. trade. With the FOMC (Federal Open Market Committee) signaling an end to the rate hiking cycle, the Dollar has little left to keep it propped up. Not to mention the fact that no one has more of a vested interest in a weak dollar than the US itself. A weak dollar is about the only way we will be able to deflate our way out of debt, and at the same time at least try and compete with China. Turning to technicals, one can see that the last few days have seen a dramatic turn up in almost all currencies against the Dollar, with the Euro as usual being the leader. Look for continued strength in the Euro. As I have said in the past ...Currencies tend to trend more than any other market. In other words once it gets going in a direction you can usually expect that trend to continue longer than most other markets. Also notice the rather large 1-2-3 bottom formation that yesterdays break out now confirms. This could be another sign that a new bullish trend is just now developing. All in all, this is a very low dollar way to be long an at-the-money call for the next month while getting better than 3 to 1 on your money.

Profit Goal

Max profit assuming a 22 point fill is 78 points ($975) giving this trade a 3.5:1 risk reward ratio. Max profit occurs at expiration with Euro Currency trading between 123 and 124. The trade is profitable at expiration if the Euro Currency is trading any where between 122.22 and 124.78 (break even points) which means we have a band of 256 points in Euro Currency that we can profit in.

Risk Analysis

Max risk assuming a 22 point fill is $275. This occurs at expiration with the Euro Currency trading below 122 or above 125.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.