| The Wagner Daily ETF Report For December 12 |

| By Deron Wagner |

Published

12/12/2012

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For December 12

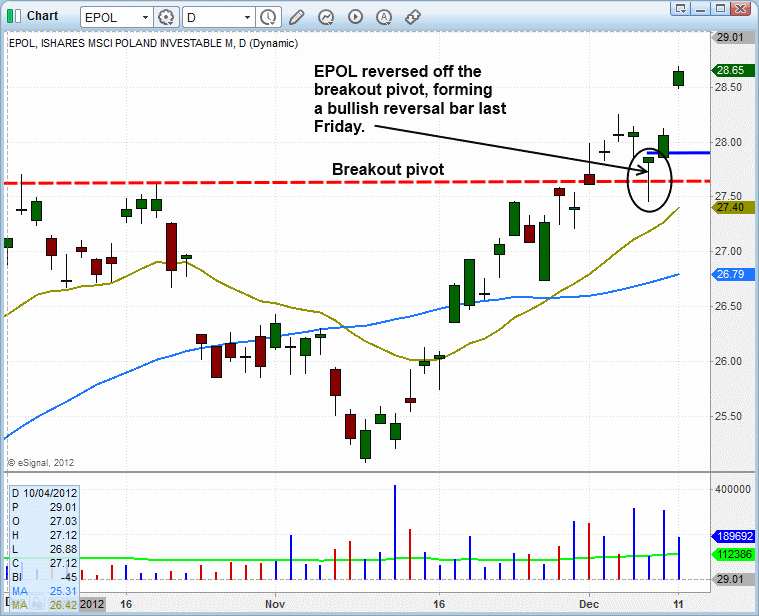

After forming a bullish reversal candle off support of a prior breakout level, iShares Msci Poland ($EPOL) has followed through nicely to the upside the past two days. The recent pullback in $EPOL is a good example of where to find a low risk entry point after a stock/ETF has already broken out using the high and low of the candle as an entry and stop. It can also serve as a low risk point to add to a position because of the tight stop beneath the reversal candle low. We did not add to our position in $EPOL because we are trading with reduced share size and did not want to increase risk.

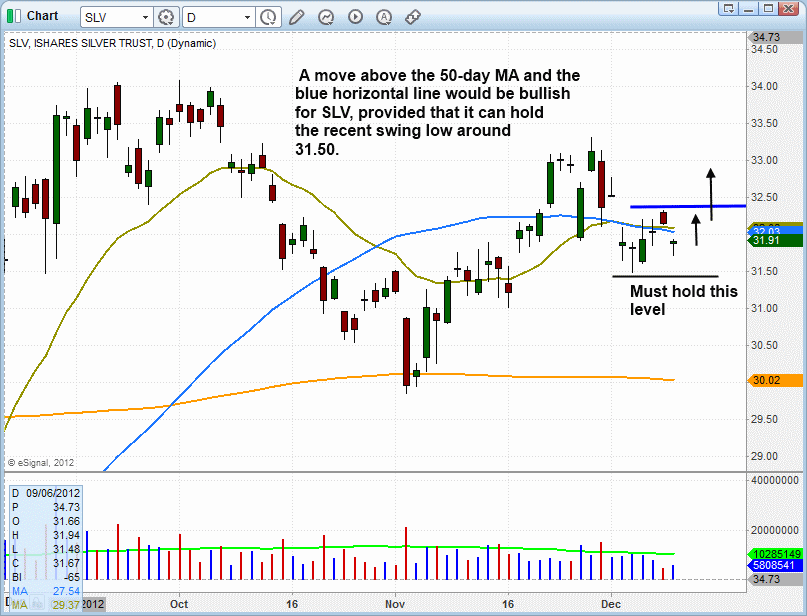

iShares Silver ETF ($SLV) is currently basing out and could trigger a buy entry sometime this week if it can climb back above the 50-day MA and the high of December 10. $SLV is not an official buy setup right now, but we are monitoring the action as long as it holds above the 31.50 area. We will no longer be interested in the trade if $SLV breaks down and stays below the December 5 low.

As the holiday season draws nearer, overall volume levels are expected to dry up as well. When turnover slides below 50-day average levels, equities are more susceptible to erratic, whipsaw price action. If you're a new trader, don't underestimate the importance of having solid turnover levels in the market, as volume is the fuel that enables trends to become firmly established. Without it, noncommittal, choppy sessions are common. Therefore, despite yesterday's breakout action in several of the main stock market indexes, we caution against becoming overly complacent or aggressive with share size at current levels. Keep in mind that our market timing model has been in "buy" mode since November 23, but the technical signals have not yet been generated to cause our timing system to shift to "confirmed buy" mode.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|