| The Wagner Daily ETF Report For December 13 |

| By Deron Wagner |

Published

12/13/2012

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For December 13

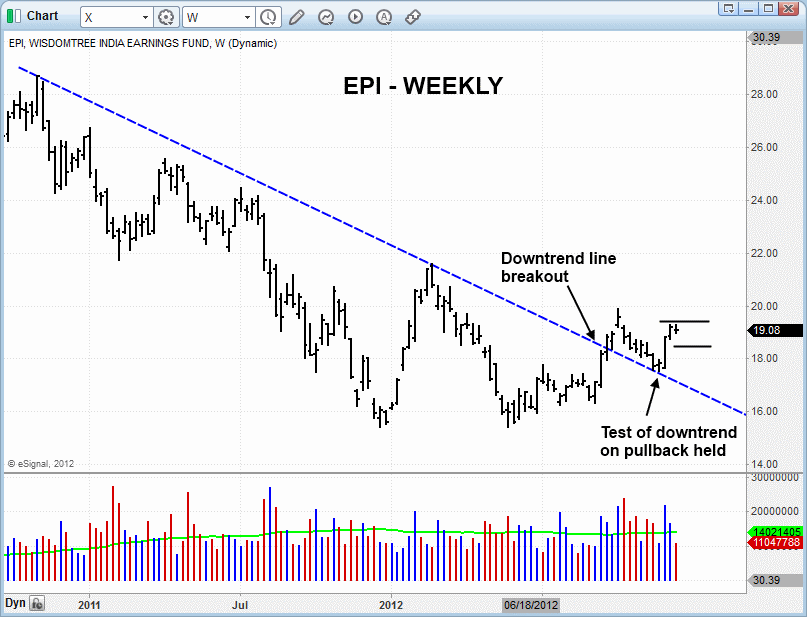

Back in August, the Wisdomtree India Fund ($EPI) broke a near two year downtrend line after holding support at 16.00 through the summer. After a quick thrust above the downtrend line, $EPI pulled back about 12% off the swing high to support of the prior breakout level at 18.00 and the backside of the downtrend line on the weekly chart below.

After successfully testing support at 18.00, $EPI broke above the short-term downtrend line and the 50-day MA on November 29. The strong thrust off the lows of the base is a bullish sign and we look for $EPI to digest the recent move with a week or two of sideways action. As with all valid trend reversals, the 50-day MA crossed above the 200-day MA and 50-day MA itself is in a clear uptrend. We look for the price action during any consolidation to at the very least hold above the 50-day MA. An ugly break of the 50-day MA would signal that the base needs several more weeks of consolidation before it is ready to push higher IF it recovers. The setup is not actionable right now but we are monitoring the action for an entry point, provided that market conditions do not continue to deteriorate.

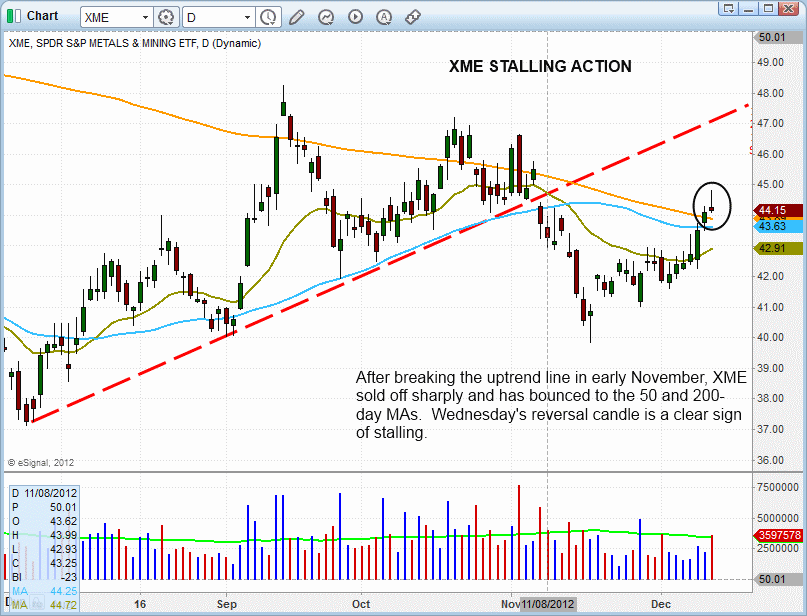

SPDR S&P Metals and Mining ETF ($XME) peaked along with the market on September 14 with a quick probe above the 200-day MA and sharp selloff. After two more stalled attempts to rally above the 200-day MA in October with each resulting in a lower highs, $XME is once again at resistance of the 200-day MA. Wednesday's bearish reversal candle could lead to a fourth failed attempt to push through the 200-day MA. $XME may offer a short entry within the next few days below the 200-day MA, but for now there is no action.

Given the lack of explosive price action in leadership stocks and the late day selling in the averages the past two days, the market could be vulnerable to a sell off in the short term. Although the market has pushed higher the past few weeks, we have not seen much of an improvement in leadership stocks and that remains a big concern. Without strong leadership it will be very difficult for the market to stage a meaningful advance. Because of this, we are making a judgment call to sell open long positions at market on Thursday's open to lock in gains. We are not calling the current rally dead, but we do not mind stepping aside for a few days and monitoring the price action.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|