| The Wagner Daily ETF Report For December 20 |

| By Deron Wagner |

Published

12/20/2012

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For December 20

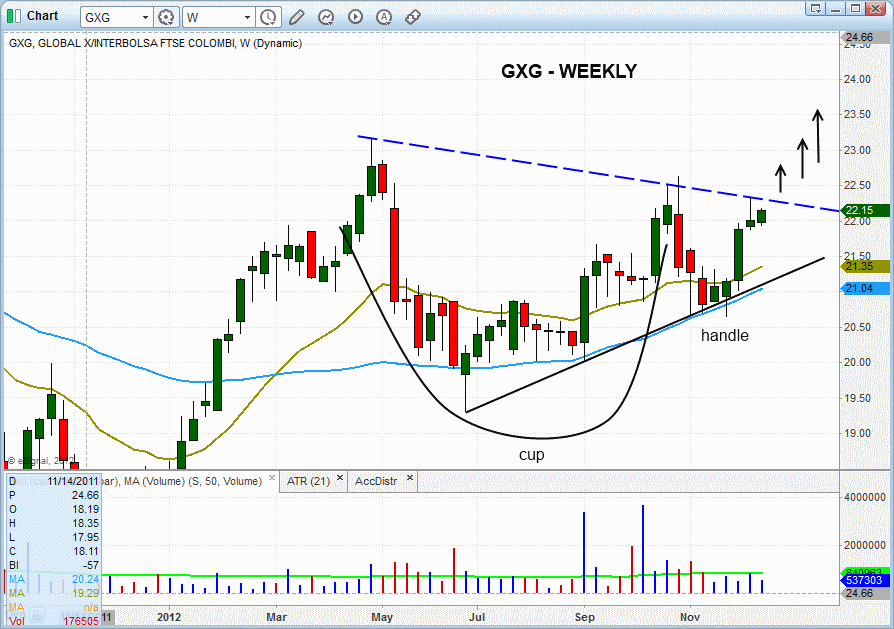

Global X FTSE Colombia 20 ($GXG) has been consolidating on its weekly chart since last May, forming a cup and handle type chart pattern, with the handle forming from late October through December. Now, a breakout above the downtrend line (blue line on the chart below) could ignite the next wave of buying.

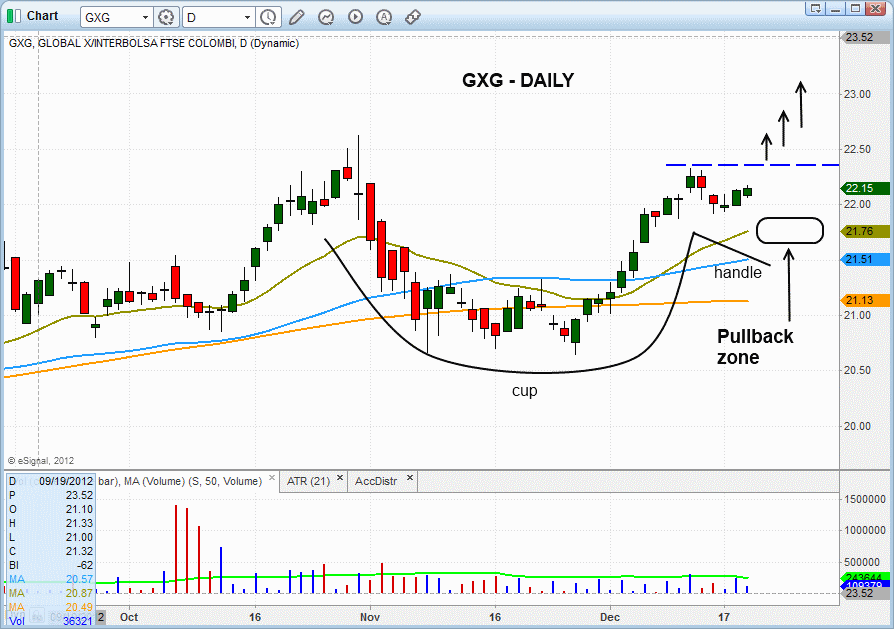

On the daily chart interval, $GXG is potentially forming a shorter-term cup and handle pattern within the larger cup and handle pattern on the weekly chart. This is bullish price action that may need a few more weeks to properly develop. A little pullback or shakeout action in the handle is a positive sign. Ideally, we would like to see $GXG pullback to support of its 20-day EMA, around the $21.80 area, over the next 5-10 days. Although this setup is not yet actionable, it is on our internal watchlist for potential trade entry in the coming days and weeks:

No new ETF swing trade setups have been added to our watchlist today. For now, it's quite possible that the main stock market indexes may have run their course for at least the rest of the year. If that is the case, we will lie low with regard to entering new trade entries. But until we see significant reason to believe market participants have actually started dumping as well, we will continue trading in the dominant direction of the near to intermediate-term trend, even if our objective, technical market timing bias frequently changes.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|