| The Wagner Daily ETF Report For January 2 |

| By Deron Wagner |

Published

01/2/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 2

The last day of 2012 proved to be quite powerful, as major averages blasted higher in what was an impressive day of accumulation. The main stock market indexes closed more than 1.5% higher across the board, with volume increasing on both the NYSE and Nasdaq by 30%. The Nasdaq Composite, which had been quite the laggard in December, closed out the year with a strong 2.0% advance, and is now back above the 50 and 200-day moving averages.

The combination of Monday's heavy volume advance and the Nasdaq reclaiming the 50-day MA was enough to put our stock market timing system back on a "buy" signal. Although the past two buy signals failed to impress, our weekend scans produced some of the best chart patterns we have seen in several months. That being said, we shy away from predictions and prefer to take it one day at a time.

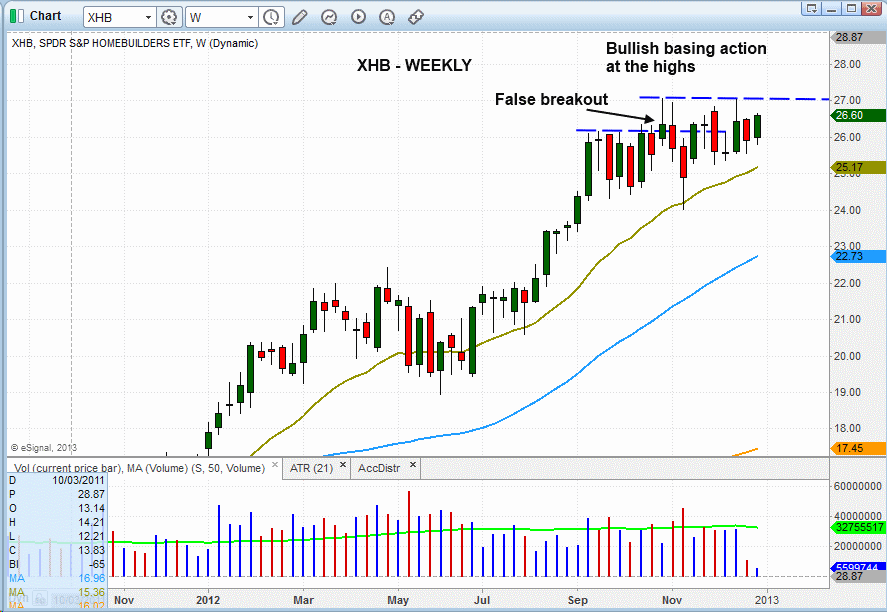

The weekly chart of SPDR S&P Homebuilders ($XHB) shows three months of tight basing action at the highs, with a false breakout in early November that led to another nine weeks of consolidation. This is shown on the chart below:

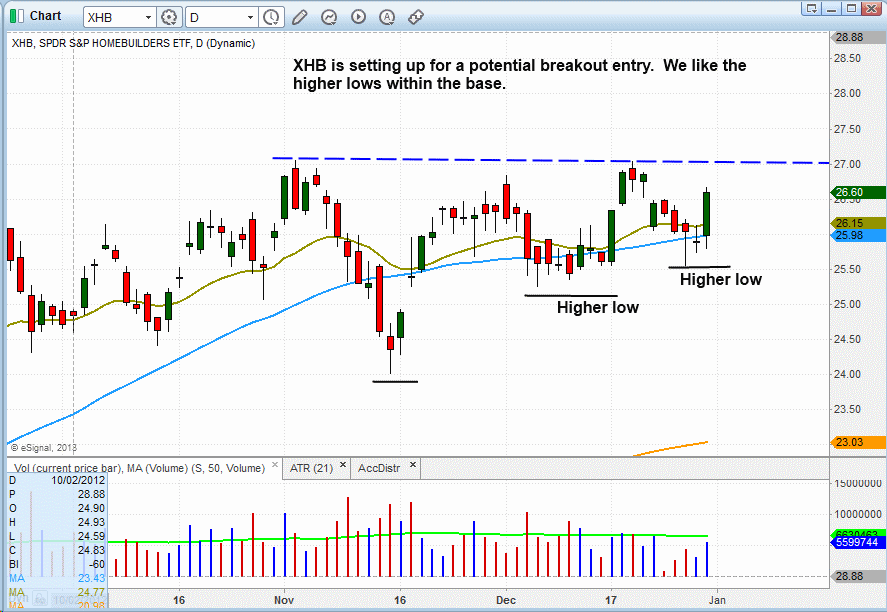

Dropping down to the shorter-term daily chart interval, we see a tight base trading around the 50-day moving average, with two higher lows in early and late December:

With the market timing model back on a buy signal, we want to continue building our long exposure as new, low-risk swing trade setups develop. The iShares Peru Index ($EPU) triggered a new buy entry in our model ETF trading portfolio on Monday.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|