| The Wagner Daily ETF Report For January 9 |

| By Deron Wagner |

Published

01/9/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 9

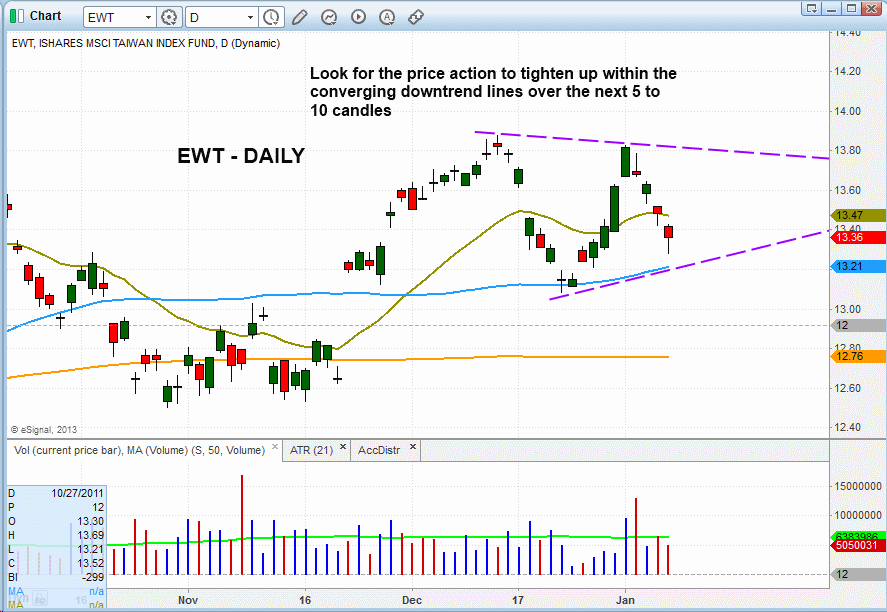

In yesterday's (January 8) ETF trading commentary, we mentioned the iShares MSCI Taiwan Index ($EWT) as a potential pullback setup within the next few days. After gapping down to "undercut" support of its 20-day exponential moving average, yesterday's action in $EWT now provides us with a low-risk entry point for partial share size, if the price moves above yesterday's high. We would then look to add to the position if the price action moves in our favor. The setup is shown on the daily chart of $EWT below:

With $EWT, we ideally are looking for the price action to tighten up over the next few weeks, in between the converging downtrend lines, while still holding above support of the 50-day moving average. Bullish basing patterns should tighten up before they breakout, as it increases the odds of the breakout holding. Subscribers to The Wagner Daily stock newsletter should note our exact trigger, stop, and target prices for this setup in the ETF Watchlist section of today's newsletter.

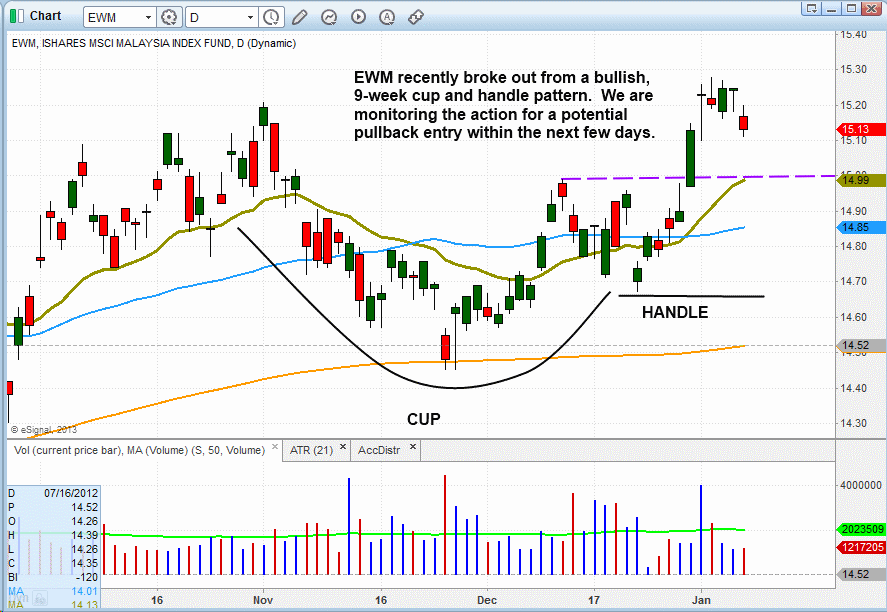

iShares MSCI Malaysia Index Fund ($EWM) recently broke out from a bullish "cup and handle" pattern. The cup portion of the pattern is the rounded out basing action, and the handle portion is the higher right side that forms just below the highs of November. Although we missed the initial breakout, about half of all cup and handle patterns retreat back to the breakout level before taking off. As such, we would ideally like to see $EWM pull back two to three more days, then test or undercut the $15.00 level and form some sort of bullish reversal candle:

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|