| The Wagner Daily ETF Report For January 16 |

| By Deron Wagner |

Published

01/16/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 16

The market has shown great resilience the past few weeks and Tuesday's action did not disappoint. Once again the broad market averages overcame early selling action and managed to push higher the rest of the day, with most averages closing in positive territory. The only index to close in the red was the Nasdaq Composite. However, the Nasdaq was able to close near the highs of the day, which was impressive action considering the ugly action in $AAPL ($AAPL dropped 3.0%).

Total volume dropped off slightly on the Nasdaq, which prevented a second straight day of distribution. Yesterday's bullish reversal candle on the S&P 500 was confirmed by a 4% pick up in volume on the NYSE. The bullish price and volume action points to higher prices for the S&P 500 in the short-term.

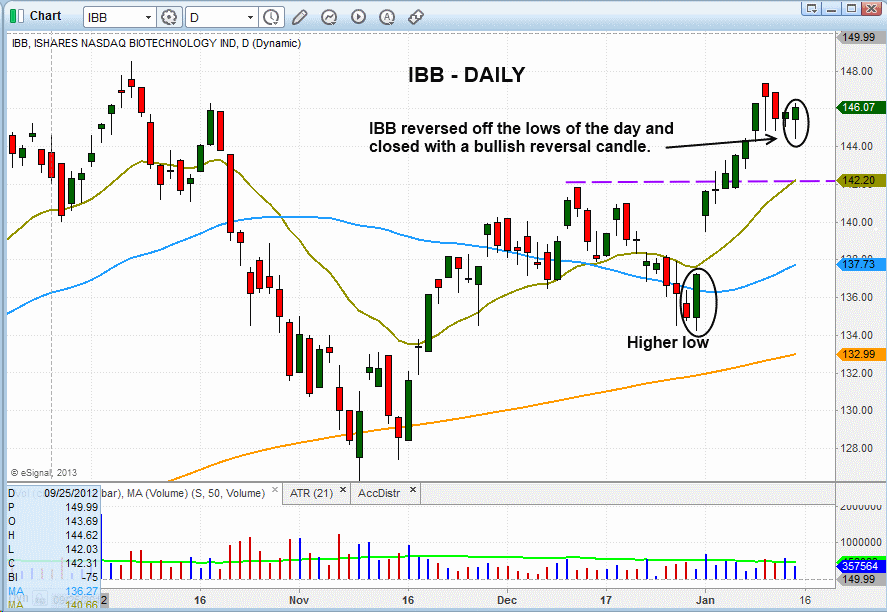

After reversing back above the 50-day MA from a large gap up on January 2, iShares NASDAQ Biotechnology Index ($IBB) rallied to the prior highs of October before pulling back in for a few days. Tuesday's price action undercut a three-day low before reversing and closing near the highs of the day. The reversal action and strong close formed a bullish reversal candle on the daily chart below.

Ideally, we'd like to see $IBB pull back closer to the 20-day EMA for a lower risk entry, but the market doesn't always give us a perfect setup.

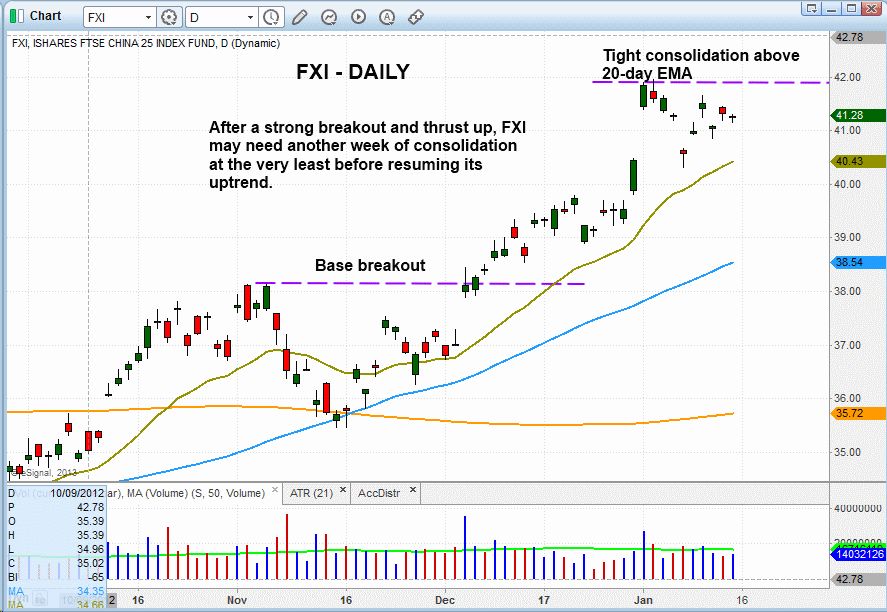

iShares FTSE/Xinhua China 25 Index ($FXI) looks to be in consolidation mode after a strong rally off the 50-day and 200-day moving averages in mid-November. If so, the price action may need another week or two of consolidation before it is ready to run higher. We'd like to see the price action hold above the 20-day EMA while forming higher lows.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|