| The Wagner Daily ETF Report For March 5 |

| By Deron Wagner |

Published

03/5/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 5

For the second day in a row, the main stock market indexes recovered from early weakness and closed near their highs of the day. However, as with the previous day's action, volume once again played spoiler, as turnover decreased on the NYSE and Nasdaq by 7%.

The major averages have found some traction over the past few days and could potentially move to new swing highs within the next day or two. A breakout to new highs would be bullish; however, we will still pass on establishing new positions until volume confirms the move. It may be tough to pass on some breakouts, but we simply can't ignore the lack of volume. Buying breakouts without the confirmation of accumulation in the market increases the likelihood of the breakouts failing.

While our weekend stock screens did not reveal many actionable setups, there are a few ETFs that have broken out from a longer-term base and may be setting up for a shorter-term, five-week base.

After breaking out above $70, iShares Dow Jones US Medical Devices ($IHI) rallied up to $76 before pulling back:

The current base is about three weeks in length and may need a few more weeks to complete. We'd like to see the price action hold above the 50-day MA (or the 10-week MA on the weekly chart) while forming a base of consolidation.

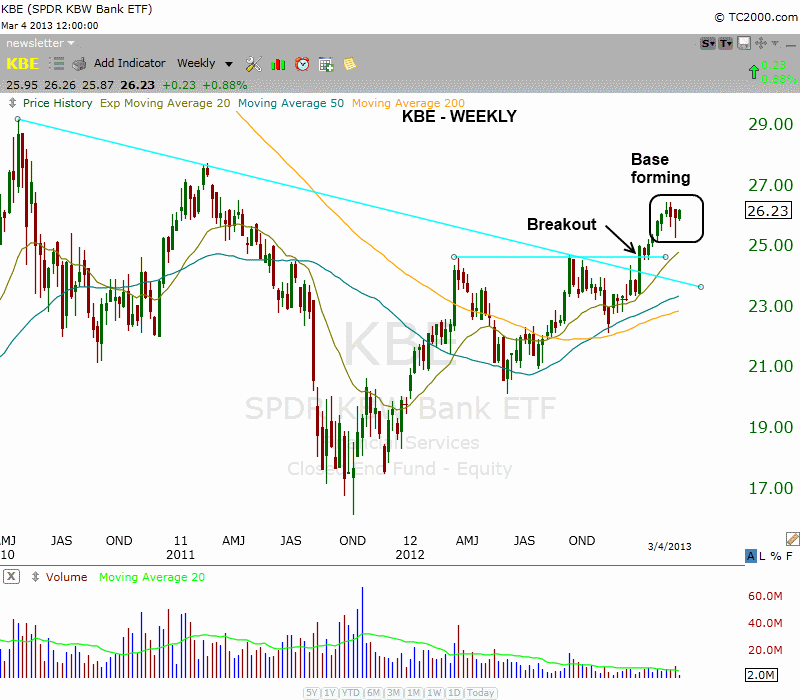

Along with $IHI, SPDR KBW Bank ($KBE) appears to be forming a short-term base after a longer-term base breakout at the $25 area. $KBE also cleared a longer-term downtrend line on the breakout, as shown on the chart below:

$KBE spent about three weeks in base mode, so a few more weeks of sideways price action before a breakout attempt would be ideal.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|