- Market: March 2006 Gold (DXH6)

- Tick value: 1 point = $10.00

- Option Expiration: 02/23/06

- Trade Description: Bear Put Spread

- Max Risk: $500.00

- Max Profit: $1500.00

- Risk Reward ratio 3:1

Buy one March 2006 Gold 550 put, and sell one March Gold 530 put, for a combined cost and risk of 50 points ($500.00) or less to open a position.

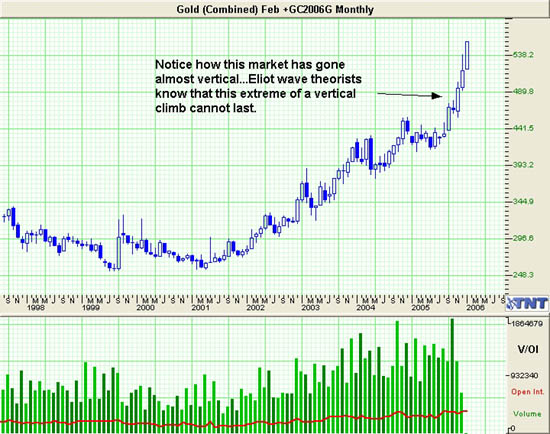

Technical/Fundamental Explanation

While I am still a long term bull the metals markets, I feel with all the headlines Gold has been grabbing that a hedge for all of our longs is in order. If you are currently long either calls or gold futures or even Newmont mining for that matter then this trade would be a very good hedge for your existing positions. If you are not currently long Gold but feel that a pull back is coming then this trade is also for you. This trade is a simple bear put spread that gives you 3 to 1 on your money while risk is clearly defined up front. Traders should hold at least 2 of these put spreads for every $100,000 currently invested in gold.

Profit Goal

Max profit assuming a 50 point fill is 150 points ($1500.00) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with the Gold trading anywhere below 530.00. The trade is profitable at expiration if the Gold is trading any where below 545.00(break even point).

Risk Analysis

Max risk assuming a 50 point fill is ($500.00). This occurs at expiration with the Gold above 550.00.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.