Showing major relative strength to the broad market, the energy sector was one of the strongest industry groups Thursday.

Going into yesterday, we had three ETFs on our watchlist for potential swing trade entry ($TBF long, $XOP long, and $XME short). Of these, both $XOP and $XME traded through our trigger price for entry, giving us two new open positions in the model ETF portfolio of The Wagner Daily.

Showing major relative strength to the broad market, the energy sector was one of the strongest industry groups yesterday. This enabled $XOP to rally above its two-day high, trigger our buy stop for entry, and then cruise nearly a full point higher after our entry. Considering the benchmark S&P 500 rose just 0.6% yesterday, the 2.7% intraday gain of $XOP was rather impressive. Most importantly, it was a good sign that we were targeting the right sector with relative strength.

So far, we have only bought a partial position of $XOP, as we were ideally looking for a lower-risk entry point (a pullback to near last week's breakout level) in order to take larger share size. However, now that we have confirmation that last week's breakout was legitimate, we will seek to add additional shares to this position when it forms a bull flag, pulls back 2 to 5 days off its high, or consolidates in a tight range. The daily chart of $XOP is shown below:

The other ETF that triggered for swing trade entry was a short position in $XME. As mentioned yesterday, we rarely sell short any stocks or ETFs when our market timing system is on a "buy" signal. However, the one exception is when there is quite substantial bearish divergence (relative weakness) between a particular sector or ETF and the broad market.

Indeed, there has been huge relative weakness in the Metals and Mining sector ($XME), which has been in a downtrend and consolidating near its 52-week lows, even as the major indices have been hanging out at or near fresh multi-year highs.

If a stock or ETF is so weak that it continues to trend lower, even while the overall stock market pushes higher, what do you think happens when the broad-based rally eventually takes a rest or pulls back? The ETFs and stocks with the most relative weakness are usually the first to fall apart to new lows.

The initial trade idea to sell short $XME came to us after scanning the weekly chart pattern, at which point we noticed a bearish "head and shoulders" chart pattern had formed, and the pattern was poised to complete itself by breaking down below the neckline. This is annotated on the weekly chart below:

Since we typically only discuss our short selling techniques in downtrending markets, many newer subscribers and followers of our swing trading system may be wondering exactly how our short selling strategy differs from buying (going long).

To answer that question, please take just a few moments to read How To Find The Best Entry Points For Short Selling Stocks, which we posted on our trading blog after the October 2012 "sell" signal was generated.

After reading the aforementioned blog post about short selling, the take away should be that we're not big fans of initiating new short entries as the stock or ETF is breaking down below an obvious level of price support. Rather, we prefer to wait for the breakdown to happen, patiently wait for the subsequent bounce into new resistance (prior support level), then hammer the first big down day (or gap down) that follows.

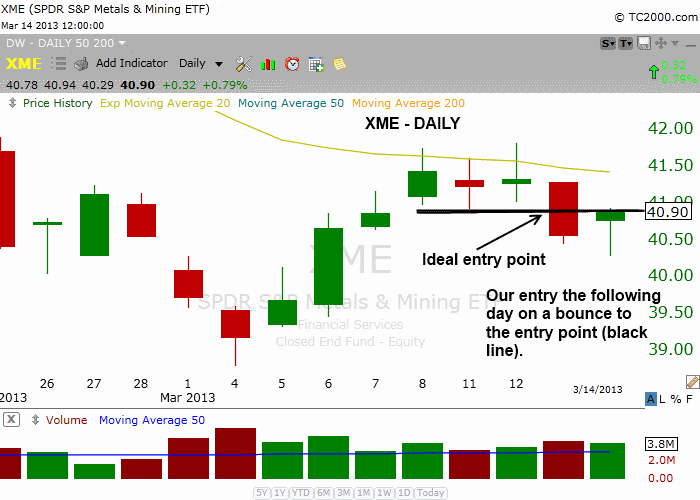

Entering new short positions using this methodology increases the odds that price momentum has already returned to the favor of the bears. It's a much better overall methodology than trying to guess how high a downtrending stock will bounce and then blindly selling short while the stock is still moving higher. On that note, let's zoom in to the see the actual entry point on the shorter-term daily chart below:

Above, notice that $XME recently broke down below support of its November 2012 low (the horizontal line), then bounced into near-term resistance of its 20-day exponential moving average (beige line). After three days of trying to move above that resistance level over the past week, $XME sold off sharply on March 13, causing the big red bar to print.

The best entry point for selling short $XME was actually two days ago (March 13), rather than yesterday, because the trigger price for the most ideal short entry was on the breakdown below the low of the prior three days (around $40.93). However, because we are swing traders, all of our trade entries and exits are based on end-of-day price action (which makes it easy for our subscribers with daytime jobs to still follow our system).

One great thing about swing trading is that we can usually still get a very nice entry price the following day, even if we were unable to take action the same day the stock or ETF broke through the pivot. In this case, we simply waited for a small retracement (bounce) off the March 13 low, and then initiated a new short position with our sell limit order at $40.79. This gave us a an entry price within just 15 cents of where we would have sold short on March 13 (if our system allowed intraday trading decisions).

Sometimes, of course, a weak stock or ETF near its lows continue tumbling straight down, without bouncing to give us a low-risk entry price. But that's okay...we simply move on to find the next ideal trade setup. Remember that nice entry points on short sales can be achieved by waiting for just a small retracement of the prior day's range (as long as the price has already bounced off the lows and formed a big bar down). Since $XME closed less than 10 cents above our entry price yesterday, this trade is looking just fine so far (as is $XOP).

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.