The iShares Dow Jones U.S. Medical Devices Index (IHI) broke out from a long-term base of consolidation in early January, then rallied about 7% higher before stalling out.

The iShares Dow Jones U.S. Medical Devices Index ($IHI) broke out from a long-term base of consolidation in early January, then rallied about 7% higher before stalling out. Since then, it has formed a tight, six-week base near its 52-week high:

The weekly chart above is looking quite solid, as the 10-week moving average (teal line) is pulling away from the 40-week moving average (orange line). This indicates a strengthening of the bullish trend. Also, notice how the rising 10-week moving average has provided support on each pullback within the base.

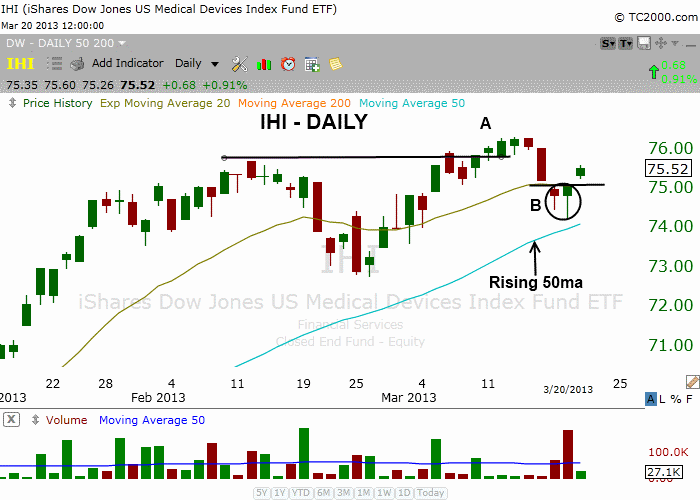

On the shorter-term daily chart below, $IHI put in a false breakout to new highs on March 6 (point "A"), and once again on March 12 and 13. The last failed breakout attempt led to a quick three-day shakeout, which produced two reversal candles in a row below the 20-day exponential moving average on March 18 and 19 (point "B").

The false breakout, which is positive because it absorbs overhead supply, looks to have potentially created a "higher low" within the base (assuming the March 19 low holds).

Because of the bullish weekly chart pattern, combined with a low-risk entry point now setting up on the daily chart, we are now stalking $IHI as a potential swing trade buy entry going into today's session. Regular subscribers to The Wagner Daily should note our exact trigger, stop, and target prices for this setup in the "watchlist" section of today's report.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.