| The Wagner Daily ETF Report For March 22 |

| By Deron Wagner |

Published

03/22/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 22

Ever since our market timing model shifted into a new "buy" signal on March 5, we have not been pleased with the overall price action of the stock market. With the exception of one day, the entire rally to new highs has been unconfirmed by the presence of higher volume over the past several weeks.

Since our model for timing the stock market is rule-based and proven to consistently work over the long-term, we have simply been following it. But why would we be in "buy" mode if volume failed to confirm this month's breakout to new highs for the major indices? The answer is simple. Price action is always king, while volume is queen. Although we need to see the confirmation of higher volume in order for breakouts to be confirmed, we also cannot sit back and watch the stock market move to new highs without us in it.

In market environments such as the present, we lower risk in one of two ways. First, we intentionally size the positions so that each new swing trade entry is significantly lighter than than our maximum risk parameter of $500 per trade (based on our model portfolios). The other option is to not assume much overall risk exposure in the portfolio. We have been doing both of these things ever since the March 5 buy signal; nearly every trade entry has been around 50% of maximum risk per trade, and we've also not been exceeding more than about 40% of the model portfolio's cash value.

Modeling our swing trading portfolio in the way described above positioned us to benefit if the market moved higher, but still limited our risk if stocks suddenly moved lower and the recent breakout failed (which wouldn't be surprising given the lack of volume confirmation).

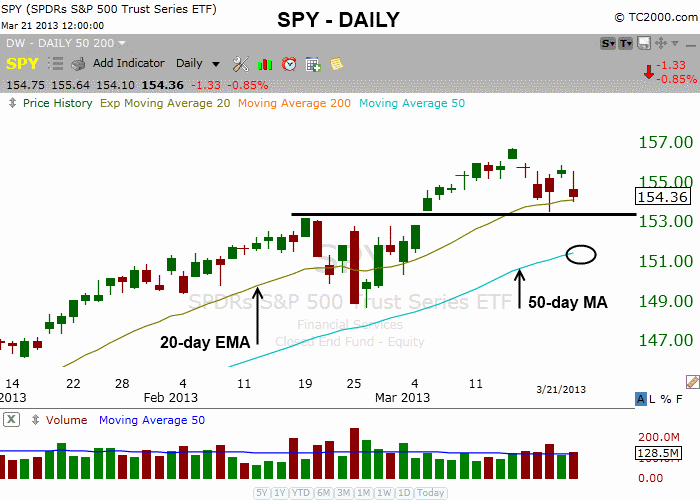

Over the next few days, we will be closely monitoring the price action in the S&P 500 Index, which has been showing leadership compared to the NASDAQ for several months. As annotated on the daily chart below, the S&P 500 SPDR ($SPY) is nearing a key near-term level of price support. If the lows of the past two days in $SPY are breached, it would be indicative of a failed breakout to new highs. With two or more distribution days, our stock market timing technique could soon revert back to a "sell" signal.

As for specific ETFs, we have noticed that money is the rotating out of financials (which was the leading sector on the way up), and rotating into the energy sector. If the stock market remains at least somewhat healthy in the coming weeks, we could see further gains in energy sector (gas/oil stocks and ETFs). That's why we entered SPDR S&P Oil And Gas ETF ($XOP).

As explained in our March 18 analysis, we also continue to look for a low-risk short selling entry point into SPDR Gold Trust ($GLD), which ideally would be a bounce to the $158-$160 area, followed by a large opening gap down or a big intraday selloff.

Everyone's talking about how the Cyprus news will cause gold to explode higher, but it certainly has not reacted very positively to the news this week. That's because it's dead on a technical level, so we don't care about news. Although it's not on our "official" watchlist going into today, we are still internally monitoring the price action of this ETF.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|