| The Wagner Daily ETF Report For March 26 |

| By Deron Wagner |

Published

03/26/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 26

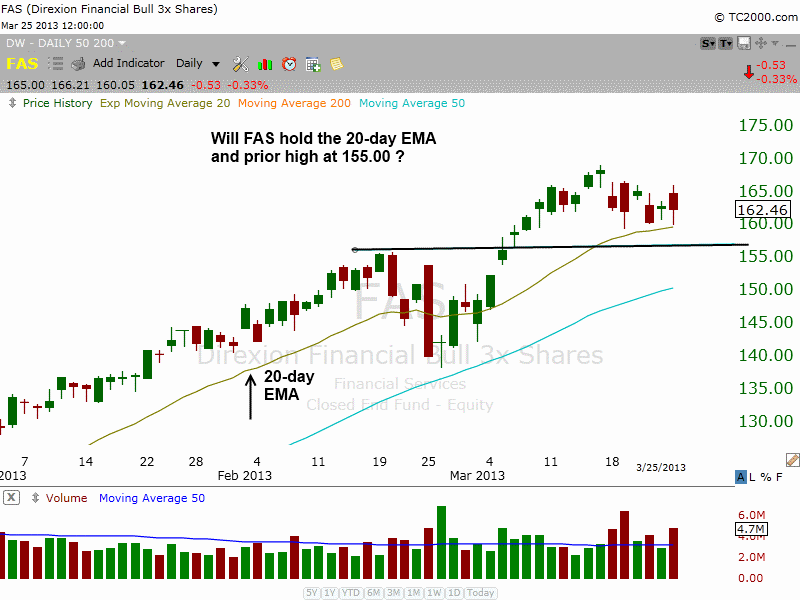

Transports, financials, and energy stocks have shared the leadership role during the current rally in the S&P 500. While most energy ETFs are currently not extended, transports and financials are. However, the Direxion Daily Financial Bull 3X ($FAS) is still in good shape, forming a bull-flag type pattern on its daily chart:

Generally speaking, if the left side of a bull flag pattern takes two weeks or less to form, then the right side (the flag) should breakout within two weeks as well. The bull flag is a continuation pattern, so if the right side of the flag takes more than two weeks to move out, then the stock or ETF will probably need several more weeks of base building before it is ready to go.

$FAS has support from the prior high (around $155) and the rising 20-day EMA near $160. A clear breakdown below the 20-day EMA could lead to a pullback to the 50-day MA, which is around $150.

After clearing the highs of the last base around $77.00 in February, Energy Select Sector SPDR ($XLE) has formed a tight, eight-week base above the rising 10-week MA. If the broad market rally is to continue, institutional funds will need to flow out of extended groups, and into those that have been basing out for a few weeks (such as $ITB-Homebuilders and $XLE). There is quite a bit of support for $XLE at the $77 area, so this level should hold if the ETF is to breakout within the next few weeks.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|