| The Wagner Daily ETF Report For April 19 |

| By Deron Wagner |

Published

04/19/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 19

Stocks continued to sell off on Thursday, with tech stocks getting hit the hardest. The Nasdaq Composite sold off 1.2%, while most averages closed lower by 0.6% to 0.7%. The Nasdaq sliced through key intermediate-term support of its 50-day moving average, joining the Russell 2000 and S&P Midcap 400.

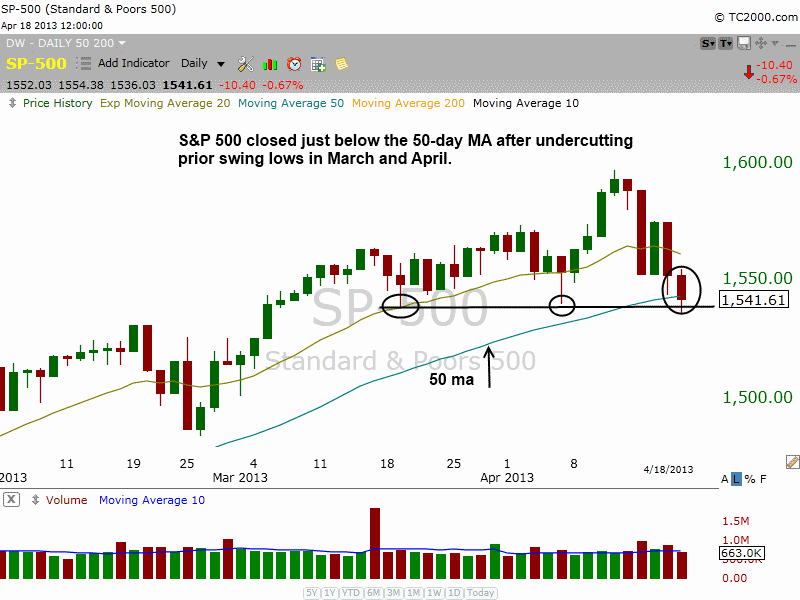

The S&P 500 closed just below (but not a decisive break of) its 50-day moving average yesterday, after undercutting its prior "swing lows" at the 1538-1539 support level:

The 50-day moving average is a very important support level during a rally, as it is basically the line in the sand for the bulls. When the major averages all break below the 50-day MA within a few days of each other, it is usually a good time to raise cash and sit on the sidelines.

The evidence below suggests that the market is now in a corrective phase, which forces our rule-based timing model into sell mode:

There are at least 5-6 distribution days in the market (strike 1).

Most of the main stock market indexes are trading below the 50-day MA (strike 2). We do not count the Dow.

Leading individual stocks are beginning to break down below key support levels (strike 3).

How long will a stock market correction last? No one knows, but there is one main clue to watch out for.

Can leading stocks that have recently broken down find support and stabilize? There is a big difference between leading stocks pulling back 15-20% off a swing high versus completely breaking down and selling off 40% or more from their highs. If most stocks hold above or around their 50-day MAs and fall no more than 20-25% or so off their swing highs, then we would expect any correction in the S&P 500 to be limited to around 4-6%.

As for our current positions in the model portfolio of The Wagner Daily swing trading newsletter, we are presently holding 2 ETFs and 2 individual stocks.

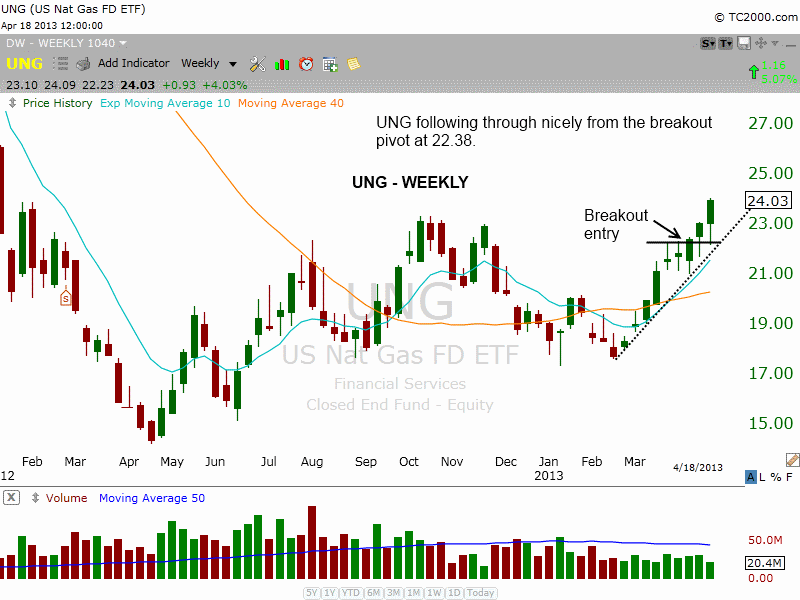

US Natural Gas Fund ($UNG) is in pretty good shape after yesterday's (April 18) strong advance. The weekly chart below shows $UNG zooming above the breakout pivot, which is always a bullish sign:

As annotated on the chart above, $UNG is holding support of a steep uptrend line (black dotted line), while the 10-week MA (teal line) is beginning to pull away from the 40-week MA (orange line) after the bullish crossover a few weeks ago.

As you may recall, our actual swing trade buy entry into $UNG was based on the "cup and handle" chart pattern we originally pointed out in this April 2 post on our blog. Presently, $UNG is showing an unrealized gain of 6% since our April 8 buy entry, and is well positioned to continue higher.

The other open ETF position in our model portfolio, Market Vectors Semiconductor ETF ($SMH), is holding above its prior swing low, but is struggling to reclaim its 50-day MA. Nevertheless, based on our March 28 technical analysis of the semiconductor sector, we are still bullish on the intermediate-term bias of $SMH.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|