| The Wagner Daily ETF Report For April 23 |

| By Deron Wagner |

Published

04/23/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 23

Led by solid gains in the Nasdaq 100 and Nasdaq Composite, stocks closed higher across the board. The Nasdaq complex easily outperformed the S&P 500 on Monday, signaling that money is beginning to rotate out of the S&P 500 (and Dow) and in to the Nasdaq.

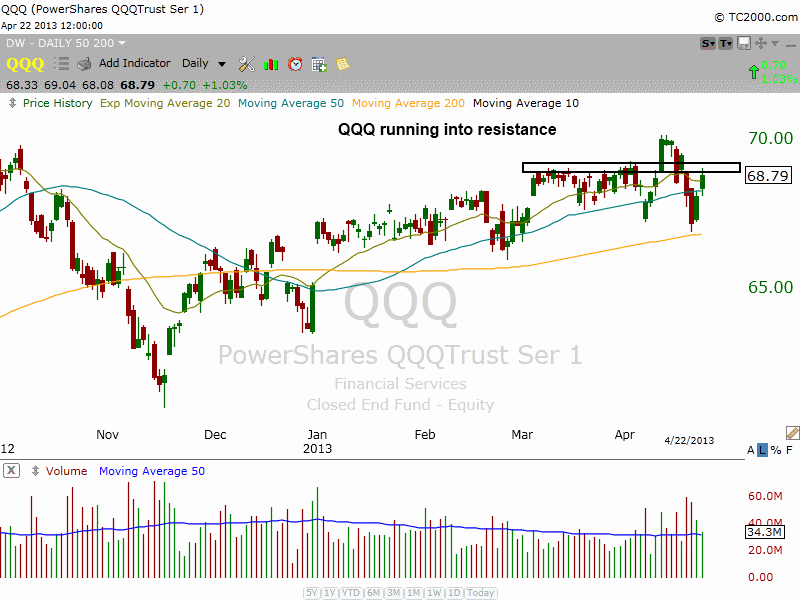

Over the past two sessions, the Nasdaq has climbed about 2.5% off last Thursday's low; however, volume has declined the past two sessions, failing to confirm the move. The Nasdaq may need a bit more time to consolidate, as there is quite a bit of overhead resistance. Looking at the daily chart of the Nasdaq 100 ETF ($QQQ) below, we see price action running in to resistance clustered around $69.00:

The five weeks of stalling action near $69, along with the 10 and 20-day moving averages, make for quite a bit of resistance. However, if $QQQ can power through this level without further consolidation, it would be a very bullish sign.

Market Vectors Semiconductor ETF ($SMH) continues to chop around near the pivotal, intermediate-term indicator of its 50-day moving average, with support coming in around $34.50 last week. If $SMH can set a higher swing low and close above Monday's high on a pick up in volume, then it may attract enough buying interest to break the short-term downtrend line and test the highs of the base:

In case you missed it the first time, last month's post on our trading blog contains our initial, more extensive bullish analysis of $SMH and the semiconductor sector.

In today's Wagner Daily newsletter, we are stalking $SMH for potential swing trade buy entry if it meets our technical criteria (looking to add to our existing position on strength). Subscribing members should note the details for $SMH in the "watchlist" section of today's report. Presently, all five of the open positions in our model trading portfolio (3 ETFs and 2 individual stocks) are showing unrealized gains.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|