| The Wagner Daily ETF Report For April 24 |

| By Deron Wagner |

Published

04/24/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 24

Yesterday's (April 24) price and volume action combined for a solid all-around session, with all major averages gaining 1.0% or more on higher volume. The pick up in volume was a positive sign for a market that has rallied off the lows on weak volume. The S&P 500 and Nasdaq have bounced up near the prior swing highs after an ugly selloff, so we could potentially see the market consolidate for a day or two to digest recent gains.

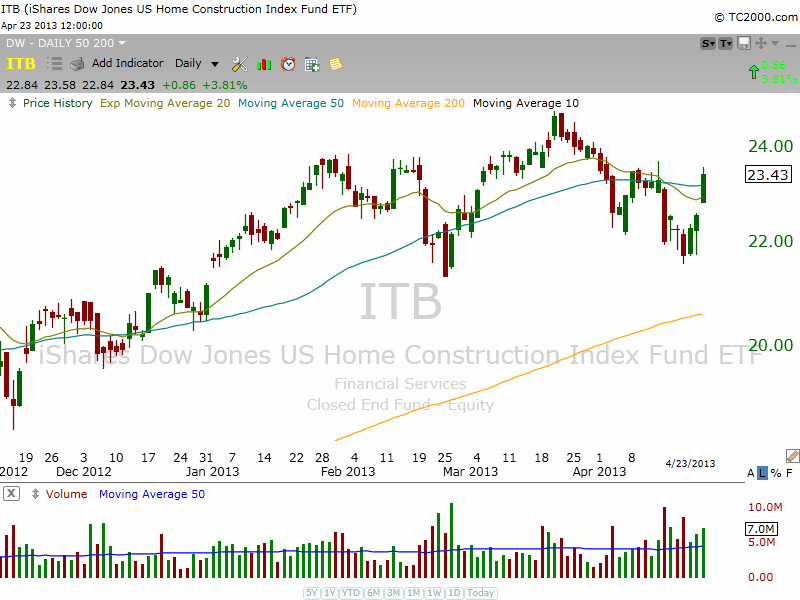

Although our market timing model technically remains on a "sell" signal, the price action in leadership stocks since April 18 has been bullish. ETFs that led the market higher during the last rally, such as Financial SPDR ($XLF) and iShares Home Construction ($ITB) are no longer leading, but they are holding up. As long as we continue to see leadership rotate, then we have to believe that the market has more upside.

As shown on the daily chart below, $ITB reclaimed support of its 50-day MA yesterday on higher volume. The swing low from February is holding up, and as long as $ITB continues to set higher swing lows within a base, we must view the price action as constructive:

The same goes for $XLF, which has held the 50-day MA the past few weeks and could potentially run to new highs on the year this week:

The bond market, which ripped higher in April, may have topped out in the short to intermediate-term, after forming a bearish reversal candle yesterday. The daily chart of iShares 20+ Year T-Bond ETF ($TLT) is getting a bit extended away from its 20-day exponential moving average and has been stalling out just above the 200-day moving average over the past two weeks. We could potentially see funds rotate out of the bond markets (using $TLT as an ETF proxy) and back into equities sooner, rather than later, if the stock market continues to act well:

As for the open ETF positions in our model trading portfolio, Market Vectors Semiconductor ETF ($SMH) reclaimed support of its 50-day moving average on heavy volume yesterday. As per the plan in yesterday's Wagner Daily swing trade newsletter, we added to our existing position as the ETF rose above its 5-minute opening high. After jumping more than 2% yesterday, $SMH is now just pennies away from breaking out above its base of consolidation to a fresh 52-week high in the coming days.

Our new position in iShares Indonesia ($EIDO) followed through to the upside yesterday, with a solid gain of 0.7% on decent volume.

US Natural Gas Fund ($UNG) closed below its 10-day moving average, but on light volume. Ideally, we'd like $UNG to hold this support level, but a pullback to the 20-day exponential moving average would simply suggest that the action may need another week or two of consolidation before heading higher. The weekly "cup and handle" pattern that initially prompted our intermediate-term buy entry remains intact.

In addition to the three ETFs we are holding, both of our individual stock swing trades are looking great so far. Celldex Therapeutics ($CLDX) closed at another all-time high yesterday, and is now showing an unrealized gain of 17% since our April 9 buy entry. LinkedIn ($LNKD) also finished at a fresh record high yesterday, and is presently up 6.8% since our April 9 entry.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|