| The Wagner Daily ETF Report For April 26 |

| By Deron Wagner |

Published

04/26/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 26

After an ugly, two-day meltdown in SPDR Gold Trust ETF ($GLD) on April 12 and 15, the price of $GLD has bounced higher over the past two weeks, and has just "overcut" very near-term resistance of its 10-day moving average. Yesterday's (April 25) rally in $GLD may have wiped out some of the "late to the party Charlies" who attempted to sell short beneath the lows of 4/22 on 4/23. Yesterday's gap up may also have forced anyone who was on the fence about covering their short positions to throw in the towel by the close:

Yesterday's bullish candlestick in $GLD presents us with a low-risk short selling entry point IF the price action falls below yesterday's low. When selling short a breakdown that is bouncing into resistance, we avoid short entry points into strength because it is tough to do when there is very little overhead resistance. Instead, we wait for the first substantial move lower that follows the rally into resistance of a downtrending stock or ETF

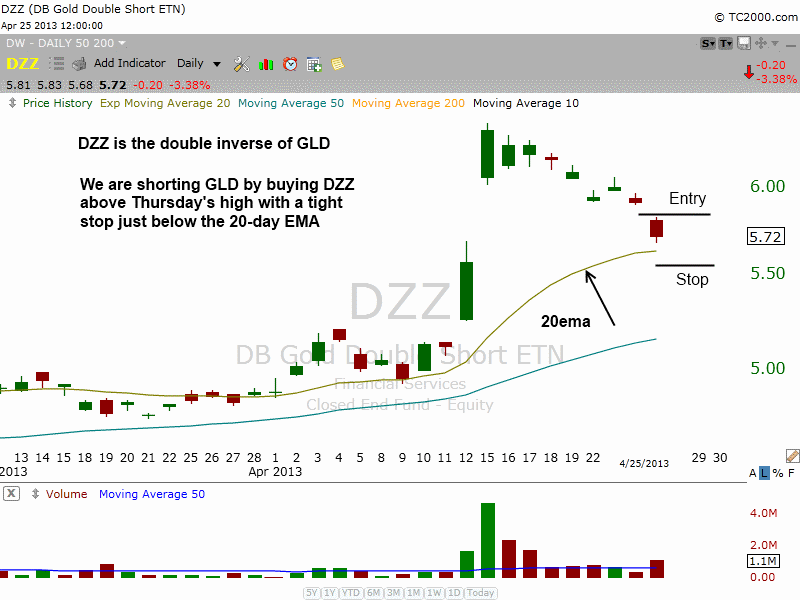

Whenever possible, we prefer to use an inverse ETF to play the short side, in order to allow traders with IRA and other non-marginable accounts to still participate in the trade. So, rather than selling short $GLD, we plan to buy the inversely correlated DB Gold Double Short ($DZZ) if $GLD meets our criteria for short entry. The setup in $DZZ is detailed on the chart below (though we are basing on trading decisions on the chart of $GLD instead):

Our existing long position in Semiconductor HOLDR ($SMH) has been following through nicely to the upside this week, and we are now up about 4% from our average entry price of $35.28 (we added to the original position). On the stock side, we sold a partial position of Celldex Therapeutics ($CLDX) for an 18% gain yesterday, and continue to ride the profit in LinkedIn ($LNKD) (currently 7.8% above our entry point). Regular subscribers should note there are also three new swing trade setups on today's watchlist (one ETF and two individual stocks).

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|