| The Wagner Daily ETF Report For May 8 |

| By Deron Wagner |

Published

05/8/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For May 8

The stock market continued its winning streak on Tuesday, as the S&P 500, mid-cap S&P 400, and small cap Russell 2000 all posted solid gains. However, there was some divergence with the Nasdaq Composite, which edged only 0.1% higher. The Nasdaq 100 closed in negative territory by -0.1%. The higher volume and stalling action in the Nasdaq suggests that there was a bit of bearish churning (selling at the highs).

After a strong rally off the 50-day MA, Market Vectors Semiconductors ETF ($SMH) has stalled out at the $38 level over the past few days. Whenever a stock or ETF breaks out and runs higher with very little rest, we like to draw a steep uptrend line to give us an idea of where potential intraday pullbacks should find support. A trend line becomes valid when there are at least 1 or 2 touches after the first two points have been established. The longer the trend line holds, the more significant it becomes:

When the price action bolts higher without looking back, we usually see the entire advance holding above the rising 20-period EMA on the hourly (60-minute) chart. This 20-day EMA will often coincide with a steep uptrend line on the daily chart, as has been the case with $SMH here. Notice how perfectly the 20-day EMA (beige line) has acted as support since $SMH took off:

Just to lock in some gains in the event of a market pullback from here, we are now raising the stop on 1/3 of the shares in our existing position of $SMH. Regular subscribers to our short-term trading newsletter should note our updated stop price in the "open positions" section of today's report.

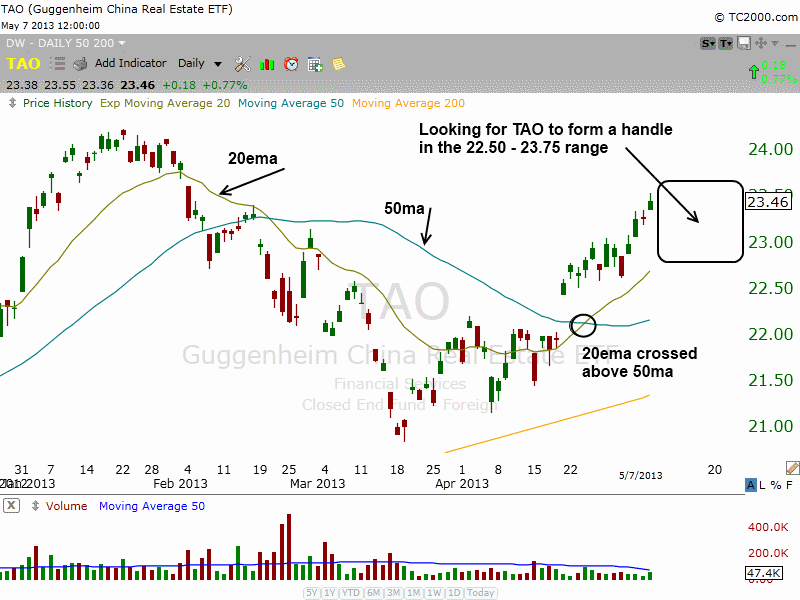

Guggenheim China Real Estate ETF ($TAO) continues to march higher, and is approaching resistance from the prior swing high in January (around the $23.75 - $24 area). Although it may sound strange, we'd prefer the price action stop going higher within the next few days and form a tight range over the next two or three weeks. This type of short-term consolidation is known as a "handle". A well-formed handle allows the price action to coil up, while shaking out the "weak hands." Ultimately, this usually leads to a more powerful and sustainable breakout that propels the price action above the highs of the left hand side of the base. We'd like to see the handle hold above or near the rising 20-day EMA:

There was some selling in a few leading stocks that are on our internal watchlist, but for the most part it was contained. $SCTY, $TSLA, $GNRC, $WDAY, $FSLR, and a handful of small-cap biotech stocks took a hit on higher volume. Overall, conditions remain bullish, but many stocks are extended in the short-term and may need a week or two of consolidation to provide us with low risk buy points.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|