- Market: March 2006 Australian Dollar (ADH6)

- Tick value: 1 point = $10.00

- Option Expiration: 03/03/06

- Trade Description: Bull Call Butterfly Spread

- Max Risk: $200.00

- Max Profit: $800.00

- Risk Reward ratio 4:1

Buy one March 2006 Australian Dollar 75 call, also buy one March Australian Dollar 77 call, while selling two March Australian Dollar 76 calls, on the same ticket, for a combined cost and risk of 20 points ($200.00) or less to open a position.

Technical/Fundamental Explanation

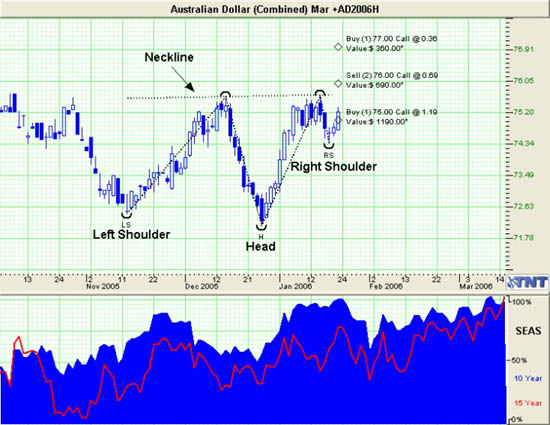

The Australian Dollar has just recently completed a classic head-and-shoulders bottom formation which I pointed out below in the chart. This is one of the oldest most reliable base patterns that I know of. While there is no sure thing, statistics show that more times than not a head and shoulders bottom formation is often a precursor to a rally. With continued strength in commodities, the Australian economy stands to gain more from this trend than almost any other nation. This is because Australia is a major exporter of those commodities that have been hot over the past few years. The breakdown in the US Dollar earlier this week is also a factor. A weakening US Dollar will push almost every other major currency higher. The Australian Dollar is no exception. Many of you have heard the saying "A rising tide lifts all ships". Well the rising tide that they are talking about is a direct result of the falling US Dollar. The US Dollar is still the engine that drives the words economy, and if that engine is stalling then the rest of the words currencies have little left to do except rally. Also notice on the bottom of the chart that February is seasonally strong for the Ausi. All in all this is about as inexpensive as one can get when putting an at-the-money bull trade on.

Profit Goal

Max profit assuming a 20 point fill is 80 points ($800.00) giving this trade a 4:1 risk reward ratio. Max profit occurs at expiration with the Australian Dollar trading at 76.00. The trade is profitable at expiration if the Australian Dollar is trading any where between 75.20 and 76.80(break even points). That means at expiration we have a 160 point range that the Australian Dollar can trade in and we can still profit from it.

Risk Analysis

Max risk assuming a 20 point fill is ($200.00). This occurs at expiration with the Australian Dollar trading below 75.00 or above 77.00.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.