| The Wagner Daily ETF Report For July 16 |

| By Deron Wagner |

Published

07/16/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 16

Broad market averages basically chopped around most of the day, with all averages closing in positive territory, but with small gains. The small cap Russell 2000 outperformed, gaining 0.6% on the day against a 0.1% gain in the S&P 500.

With our timing model in buy mode, we continue to search for low-risk breakout or pullback setups. When the market is extended, some traders have a tough time buying stocks out of fear that their entry will "call the top". This is a perfectly natural thought; however, most of the time, good trading decisions go against human nature. That is why following a system and doing the right thing can be so tough. The way we deal with a strong market is simply to focus on individual setups and position management.

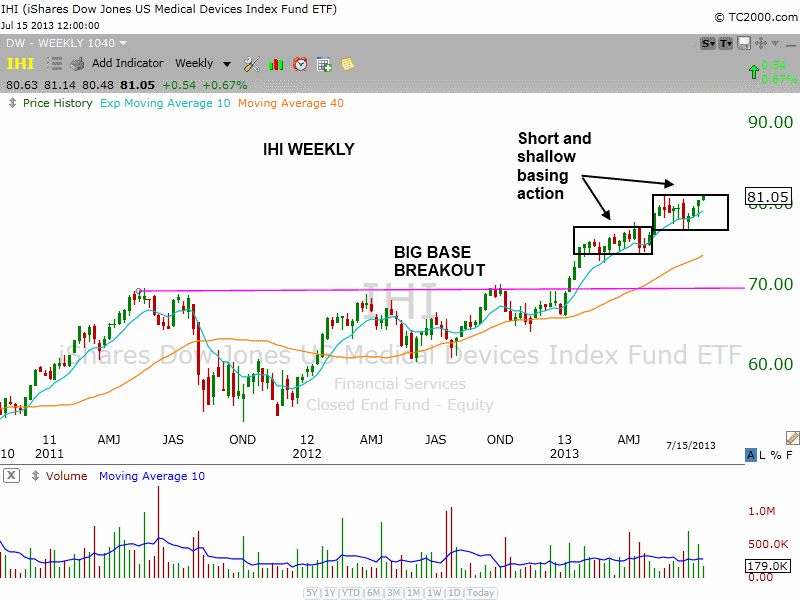

$SMH was added to the portfolio yesterday, while our other open ETF positions in Guggenheim Solar ETF ($TAN), US Oil Fund ($USO), and First Trust Internet Index ($FDN) all continue marching higher. Going into today, we have one new buy setup on our ETF trading watchlist in iShares Dow Jones US Medical Devices ($IHI).

$IHI broke out from a two-year long consolidation at the beginning of the year. After stalling out at $76 and chopping around for a few months, $IHI has formed a tight base on top of the last base during the past 8-weeks. Note the strong support at the 10-week MA, which is where the past two consolidations have found support. We often see short consolidations form after a stock or ETF breaks out from a long base. The weekly chart below is a good example of this:

On the daily chart, $IHI has broken the downtrend line of the current base after "shaking out the longs" in mid-June, on a dip below the 50-day MA. Trade details can be found in the watchlist section above. We plan to add to the position on a confirmed breakout above the range highs.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|