| The Wagner Daily ETF Report For August 9 |

| By Deron Wagner |

Published

08/9/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 9

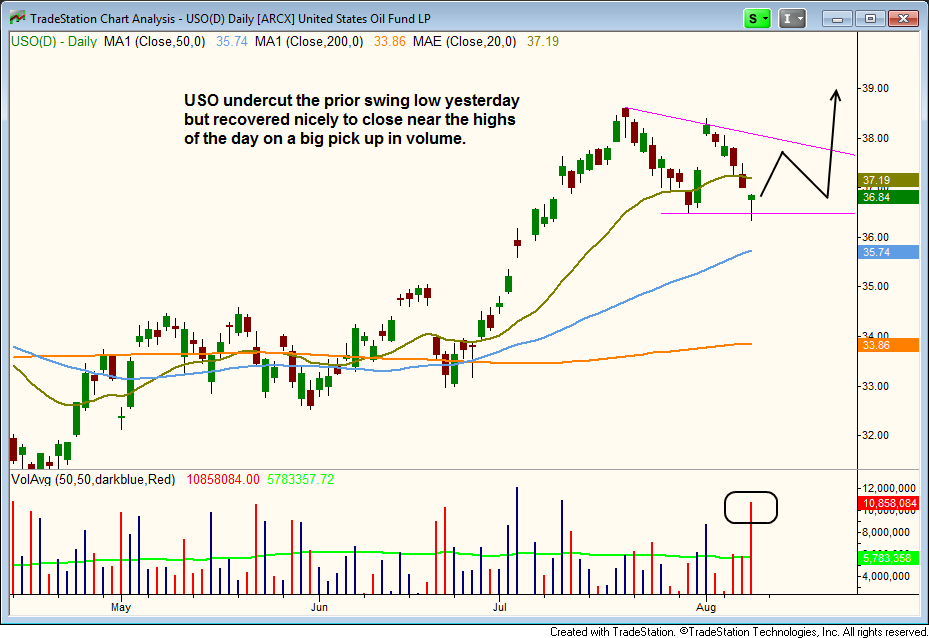

After reversing off the 20-day EMA last week and stalling at the prior high, United States Oil Fund ($USO) pulled back once again to the 20-day EMA yesterday. Before forming a bullish reversal candle on higher volume, the price action dipped below the prior swing low, shaking out some of the weak longs with tight stops.

Since $USO has failed to clear $38.50 on two attempts, but has also held support around $36.50 on both pullbacks, if yesterday's reversal holds, then we can assume that $USO is range-bound. We'd like to see the price action tighten up over the next two weeks while in between the trendlines on the daily chart below.

We will continue to monitor $USO for a low risk entry point to add to our existing position.

After a sharp selloff in the first hour of trading, the major averages found support around Wednesday's close and worked their way higher the rest of the session to close near the highs of the day. Despite the distribution days in the NASDAQ as of late, both the NASDAQ Composite and NASDAQ 100 remain above the 10-day moving average, while other indices are still above the 20-day moving average and still in pretty good shape.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|