| The Wagner Daily ETF Report For August 16 |

| By Deron Wagner |

Published

08/16/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 16

Due to the breakdown of technical support levels and recent distribution (higher volume selling) in the market, a technical change in bias was made to our market timing model yesterday (subscribing members of our swing trader newsletter should not the details at the top of today's report). Yet, despite this shift in sentiment, we are NOT yet calling the rally dead because top individual leadership stocks such as $KORS, $TSLA, and $LNKD continue to hold up.

Although the iShares U.S. Home Construction ETF ($ITB) has shown a ton of relative weakness to the broad market over the past few months, it managed to put in a bullish reversal candle on very heavy volume Thursday, after gapping down below a pivotal support level around $21.20.

If the bullish reversal holds up in today's session, we could see a weak bounce to the upside over the next few weeks, which may provide a decent opportunity for short selling entry point in the coming days. On the chart below, note that the 10-week MA has crossed below the 40-week MA, which is a bearish trend reversal signal:

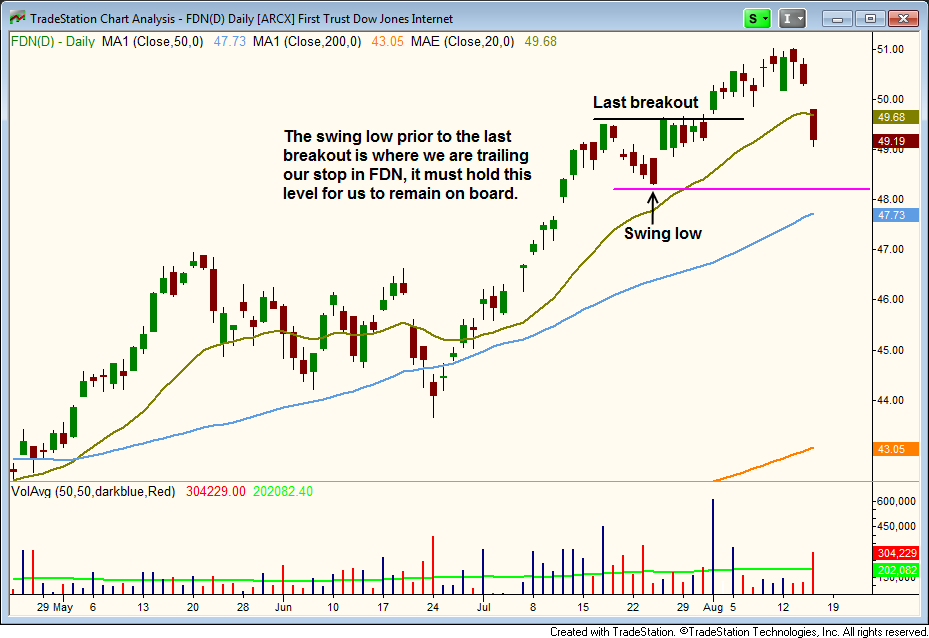

Along with the broad market, First Trust DJ Internet Index ($FDN) gapped significantly lower on the open, blowing through our tightened stop and locking in a 5.6% share price gain (on partial share size).

We are still holding 2/3 of our $FDN position, with a stop below the last swing low. When trying to ride the trend, it is best to let the market take us out of our full position rather than to predict when a trend will end (unless there is a prior resistance level in the way):

In addition to closing a partial position of $FDN, we also locked in a 9.3% share price gain on 50% of our existing position in Guggenheim Solar Trust ($TAN). Half of our position in iShares Medical Devices ($IHI) was closed for a scratch (gain or loss of less than 1%). We continue to hold US Oil Fund ($USO), which is presently showing an unrealized share price gain of 6.1% since entry and remains poised to break higher.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|