| The Wagner Daily ETF Report For August 30 |

| By Deron Wagner |

Published

08/30/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 30

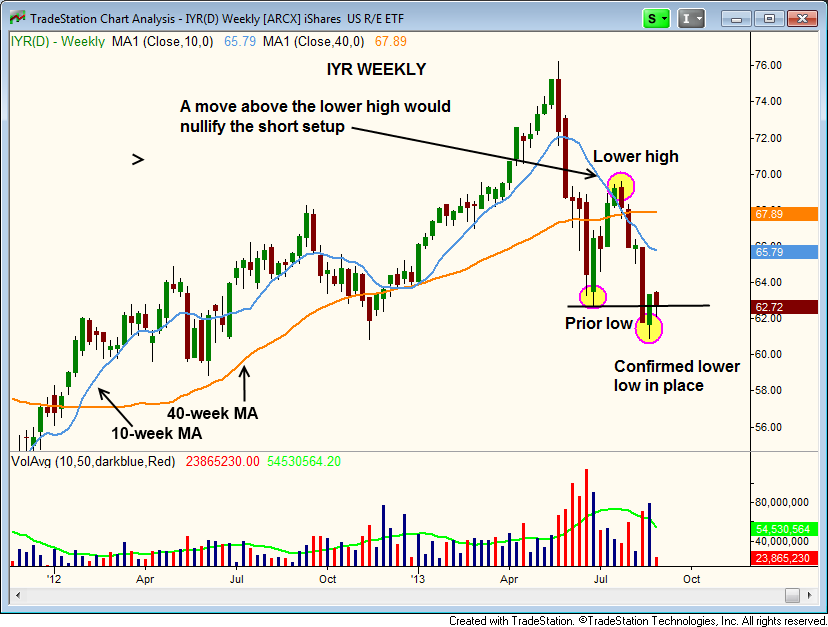

In an August 23 blog post, we pointed out iShares Dow Jones US Real Estate ($IYR) as a potential short sale setup, after it broke down below an important swing low two weeks ago.

Fast forwarding one week later, $IYR is still setting up for a major trend reversal, just as long as the price action fails to probe above the highs of June (just below $70). $IYR should have a hard enough time getting back above $66, due to resistance from a declining 10-week MA:

If $IYR is able to rally off the lows, an ideal short selling entry point could emerge on a test of the 50-day MA (around $65).

This would also coincide with the 50% Fibonacci level at $65.27, as measured from the swing high of 7/23 to swing low of 8/19. Also, note that the 50-day MA has crossed below the 200-day MA (known as a "death cross"), which indicates that a bearish, intermediate-term trend reversal is underway. This is shown on the daily chart timeframe below:

We continue to lay low due to the recent broad market divergence. The daily charts of the NASDAQ Composite and S&P 500 tell the story, as the NASDAQ is above the 50-day MA, while the S&P 500 is still below.

If the NASDAQ continues to hold above the 50-day MA, then the odds of the market going higher after a few more weeks of rest will go up. However, if the NASDAQ breaks the 50-day MA and can't recover, then we could see a deeper pullback in the overall market.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|