| The Wagner Daily ETF Report For September 18 |

| By Deron Wagner |

Published

09/18/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 18

In yesterday's ETF analysis and commentary, we pointed out the relative weakness we've been seeing in iShares U.S. Home Construction ETF ($ITB). Today, we have an ETF trade setup on our radar screen that is exhibiting the opposite characteristic of relative strength to the broad market.

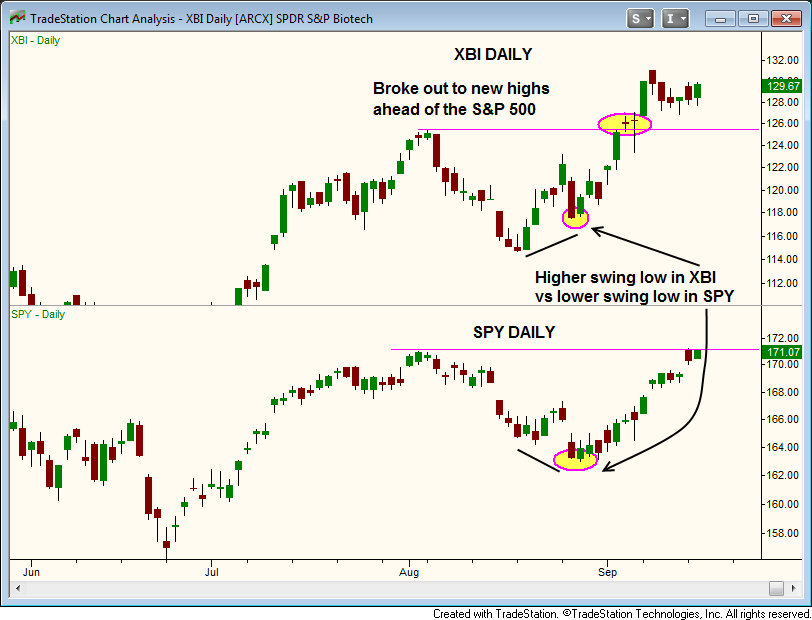

As shown on the daily chart below, notice that SPDR S&P Biotech ($XBI) has recently broken out to new highs for the year, well ahead of the benchmark S&P 500 SPDR ($SPY):

Prior to the rally to new highs ahead of the broad-based averages, observe that $XBI also set a "higher low" while the S&P 500 while the market was in pullback mode and setting a "lower low". This is a clear example of how we are continually pointing out that stocks and ETFs with relative strength are the first to surge to new highs when the broad market eventually bounces.

Aside from its relative strength, $XBI is also consolidating in a tight range, just above near-term support of its rising 10-day moving average. On the chart below, note the declining volume during the consolidation period of the past few days. This is a bullish sign that tells us the bulls are taking a rest, and the bears are not stepping in to sell at the same time:

Because of its relative strength, and bullish consolidation pattern that has followed the recent move to a new high, we are now stalking $XBI for potential swing trade breakout entry. If $XBI breaks out of its range, a rally to new highs over the next few weeks should follow. Regular subscribers of our swing trading service should note our preset and exact entry, stop, and target prices for the $XBI trade setup in the "Watchlist" section of today's report.

The Fed will release its decision on rates this afternoon at 2:15 pm ET. As such, we can expect the usual afternoon volatility.

Over the years, we have noticed that many traders will not take a position in a stock ahead of a Fed announcement, while some traders even move to a 100% cash position before such a report.

The way we deal with the Fed is the same way we deal with all news events; we simplify pay attention to price and volume action. Our goal is to concentrate on the price and volume action of each stock, as that will tell us when to buy, sell, or hold. The news doesn't matter much to us; rather, it is how our stocks and ETFs respond to news releases that matters.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|