|

The Wagner Daily ETF Report For September 23

After last Wednesday's Fed announcement, all the main stock market indexes closed the day at new multi-year or all-time highs.

However, the bullish knee-jerk reaction faded quickly, causing both the S&P 500 and Dow Jones Industrial Average to give back their post-Fed gains (and then some) just two days later.

Nevertheless, both the small-cap Russell 2000 and NASDAQ Composite showed substantial relative strength during last Friday's sell-off (both indices only surrendered a fraction of their Fed-day gains).

Furthermore, since last Friday (September 20) was a quadruple witching day, we are suspicious of the validity of last Friday's weakness.

Given last week's whipsaw action and price divergence in the broad market, let's take a basic look at the weekly chart patterns of four broad-based indexes to shed some light on the current technical state of the market.

Last Friday's bearish reversal completely wiped out Wednesday's (Fed day) strong advance, thereby creating false breakouts to new highs in both the S&P 500 and Dow Jones.

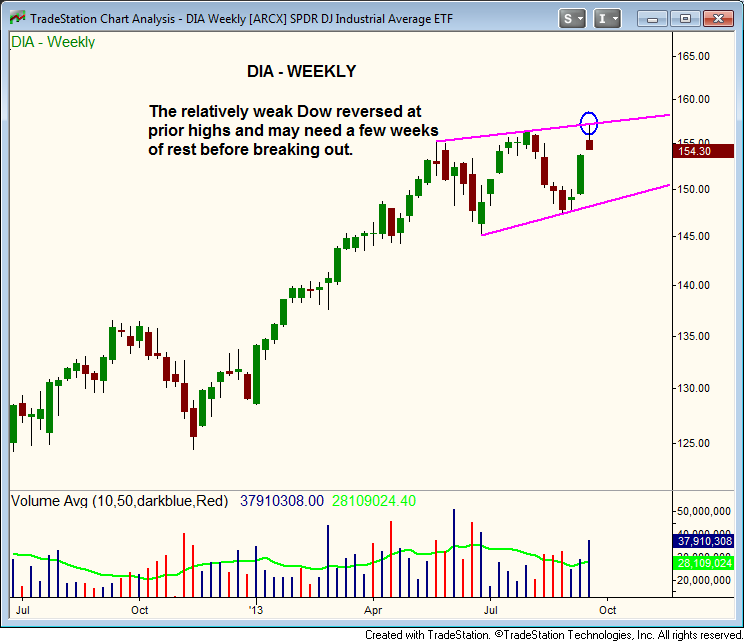

Below, this is shown on the weekly charts of Dow Jones Industrial Average SPDR ($DIA) and S&P 500 SPDR ($SPY), two popular ETF proxies for the Dow and S&P:

On the chart of $DIA above, notice that the Dow has yet to produce a convincing "higher high" over the past few months and has basically been range-bound. Next, take a look at $SPY:

The weekly chart of $SPY is more bullish, as a clear "higher low" is in place (which forms the lower channel trendline). However, the angle of its upper channel resistance is still pretty flat (just like $DIA).

Just as last Friday's losses in the Dow and S&P were greater than the declines in the NASDAQ and Russell 2000, there is quite a bit of price divergence on the weekly charts of iShares Russell 2000 ($IWM) and the NASDAQ Composite Index ($COMPX) when compared to $SPY and $DIA.

On the weekly charts of $IWM and $COMPX below, notice the upper channel trendlines are at a much steeper angle:

The relative strength on the weekly charts of the Russell 2000 and NASDAQ Composite is easy to see because there has been a clear sequence of "higher highs" and "higher lows" in place since April.

While the Dow still must overcome its prior highs to break out, the only resistance for the Russell 2000 is its upper channel trendline (which is still 3-4% away).

It's pretty much the same technical picture on the NASDAQ weekly chart, although the tech-heavy index may need to rest after bumping into resistance of its upper channel trendline.

Still, any pullback in the NASDAQ should be short-lived, as there isn't much overhead supply or resistance to contend with until the 4,000 level.

As always, remember to trade what you see, not what you think!

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|