| The Wagner Daily ETF Report For October 2 |

| By Deron Wagner |

Published

10/2/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For October 2

Not surprisingly, stocks blew off the news of the partial government shutdown and followed through on Monday's bullish reversal action. The NASDAQ Composite, Russell 2000, and S&P Mid-cap 400 each closed with gains of at least 1.2% AND at new 52-week highs. The S&P 500 rallied only 0.8%, but is now clearly back above its 50-day moving average.

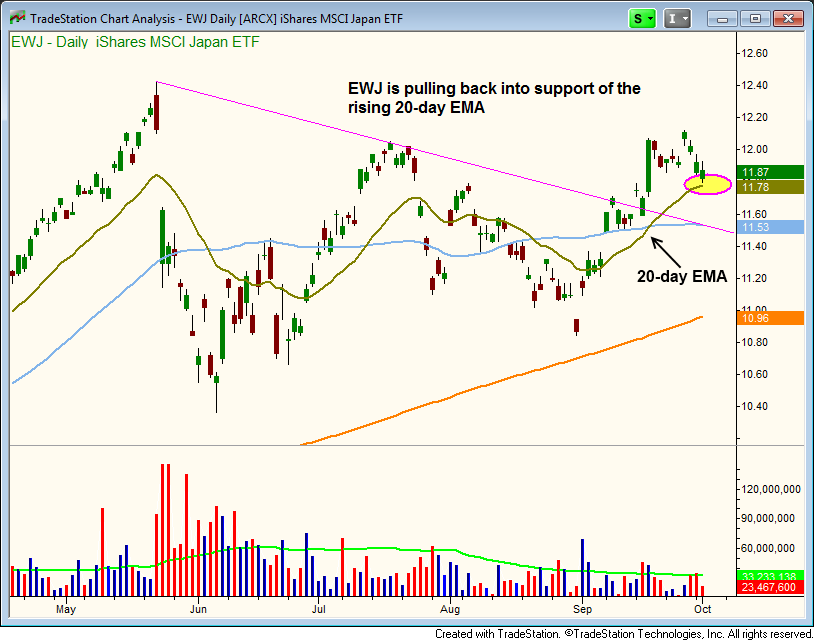

Going into today, we have one new buy setup on today's watchlist, which is iShares MSCI Japan Index ($EWJ).

Over the past month, we have pointed out the developing setup in $EWJ several times, but the price was not yet providing us with a low-risk buy entry point. But after several months of basing action, $EWJ is now poised to breakout and its price action has been tightening up over the past two weeks (above the 50-day moving average). Take a look:

Currently, $EWJ is in pullback mode and trading just above support of its rising 20-day exponential moving average. Note that the 20-day exponential moving average (beige line) has also crossed above the 50-day moving average, which started trending higher a few weeks ago.

Waiting to buy $EWJ on a breakout to new highs is tough to pull off, as the price is basically trading a full day behind by the time the US market opens.

Because of this, we prefer to buy $EWJ on weakness. With the 20 and 50-day moving averages just below, this may be the right time do so. As such, subscribing members should note our exact buy, stop, and target prices for this trade setup in the "Watchlist" section of today's Wagner Daily.

Looking at the longer-term monthly chart of $EWJ, we see clear resistance from the prior highs of 2006 and 2007 (around the $14 to $15 area). Accordingly, this is a guideline for a target price where we would like to sell into strength:

Based on an upside target price that is about 20% above where we plan to buy, we have a respectable 4 to 1 reward to risk ratio on this trade setup.

On yesterday's open, we sold our full position of Guggenheim Solar ETF ($TAN), locking in a handsome price gain of 40% on the first entry and a 15% gain on the second entry.

At the same time, our position in ProShares Ultra Silver ($AGQ) unfortunately gapped down below our stop, causing us to exit the trade with a 19% loss. Nevertheless, our position size in $AGQ was intentionally light because we were simply looking for a quick counter-trend pop.

With all new trade entries, it is important for subscribers to adjust their share size according the parameters provided in the "Watchlist" section of our swing trade newsletter. Doing so will generally allow for making more profit on winning trades and losing less cash on losing trades.

Finally, our buy setup in Direxion Daily Small Cap Bull 3X ETF ($TNA) triggered for buy entry yesterday, as it broke out to close with a 3.5% gain and at its intraday high. Click here to review our recent commentary where we pointed out the relative strength in small-cap stocks.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|