| The Wagner Daily ETF Report For October 7 |

| By Deron Wagner |

Published

10/7/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For October 7

A while back, we discussed a potential breakout in the Claymore/AlphaShares China Small Cap ETF ($HAO), as it bounced higher from a double bottom pattern, with a slight "undercut" of the prior low on the weekly chart below. Last Friday, $HAO cleared the highs of a three-week range on better than average volume, signaling the uptrend may be ready to resume after a nine-month long consolidation:

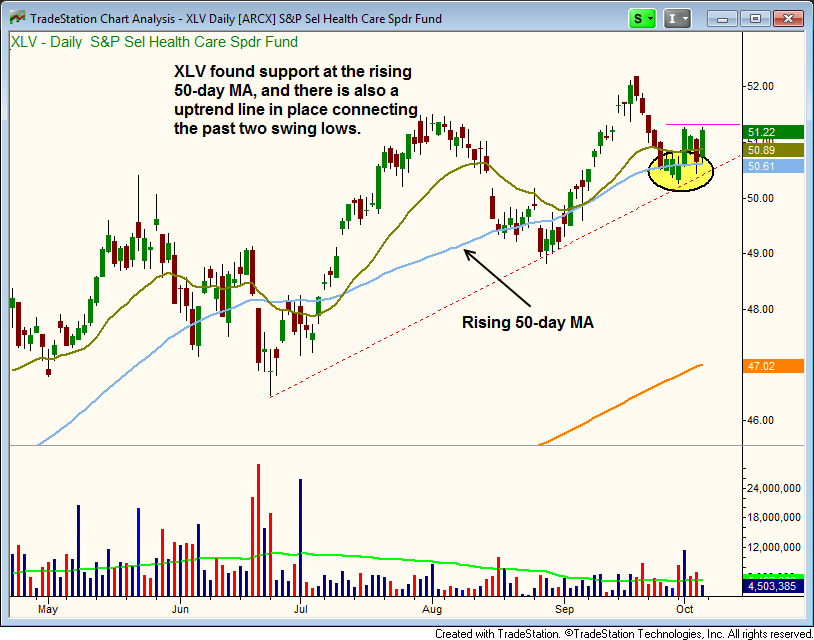

After finding support from the rising 50-day MA and uptrend line, the Health Care SPDR ETF ($XLV) is poised to attack the prior swing high, with a close above last week's high. The recent pullback in $XLV was the shortest corrective wave over the past few months, coming in at less than 3.5% off the swing high. The pullbacks in August and June were about 5.5% and 8% respectively. Whenever the price swings tighten up within a base, it is usually a good sign:

Because of the bullish patterns, we have placed both $HAO and $XLV onto our watchlist for possible buy entry today. Paid subscribers of The Wagner Daily newsletter should note our preset and exact buy trigger, stop, and target prices for the $HAO and $XLV trade setups on today's report.

To make room for potential entries in $XLV and $HAO, we are selling $USO and $FXO on the open. Because $USO is range-bound after a false breakout, it may take several weeks of choppy action before it moves higher, so we are opting to just lock in a small gain on the trade. Although $FXO could still looks okay, we are ditching our position for a very small loss ("scratch"), as we feel that setups in either $HAO or $XLV have more potential.

As for individual stocks currently in our portfolio, $YELP is now showing a share price gain of 44%, while $BITA has already rallied to an unrealized gain of 41% since last month's buy entry. $SLCA is now up more than 30%. For each of these three positions, we have raised to stops to lock in profit. With $BITA, for example, our new protective stop allows us to lock in a gain of at least 30%. Yet, $BITA could easily run another 20% to 30% higher in the next few days.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|